He Was A Tight-Fisted Hand At The Grindstone…

(Warning: Typos Intact, Not Legal Advice)

(Copyright Notice: All Headlines Are Quoted From Dickens’ A Christmas Carol)

There Never Was Such A Goose.

Can my sister refuse to show me rent, bill receipts, and bank statements?

Both me and sister were appointed co-administrators of our deceased parents estate. My sister is collecting and holding the rent. She refuses to give any receipts or show me bank statements.

It’s Enough For A Man

To Understand His Own Business,

And Not To Interfere With Other People’s

Simple Answer. No. Sister got bad advice somewhere. Why is she withholding information from her co-administrator? Plus, brother is probably co-beneficiary. Brother needs the information to carry out his responsibility as administrator of the estate. Brother is NOT free to let sister get away with this. Brother is duty-bound to challenge sister, in court if need be. Brother literally owes it to mom and dad to find out what is going on and to carry out their intention.

Interesting Note: Sister embezzles, and brother does not find out. He does not want to find out. He does not want to fight sister. He does not want to know. Brother lets it slide. Isn’t brother an accessory to elder financial abuse? Isn’t brother in big trouble?

Bottom Line: When you agree to act as trustee, agent, personal representative, patient advocate, or other fiduciary, you are taking on a big job. You must fully perform that big job. Sorry if you don’t like it, you agreed. If you did not want the job, you should not have taken it. You should have said “No.” or “NO!” Or no way, no how, not in a thousand million years.

Observation: It is no big deal to get a person to act as Trustee or Executor. The First Time. But it is damn near impossible to get that same person to do it a second time. Fool me once, shame on you. Fool me twice, shame on me.

*************

I Have Seen Your Nobler Aspirations Fall Off One By One, Until The Master-Passion, Gain, Engrosses You.

Have I Not?

Our Contract Is An Old One. It Was Made When We Were Both Poor And Content To Be So, Until, In Good Season, We Could Improve Our Worldly Fortune. You Are Changed. When It Was Made, You Were Another Man.

Should I sign a post-nuptual?

My husband and I bought a house almost 3 years ago. My husband put the down payment, a portion of which his parents gave him.

I am equally responsible for the loan and my name is on the deed. I contribute to the household expenses every paycheck. We renovated the basement, to which we both contributed, my husband much more than I. He is insisting that I sign a post nup saying that he would get back every penny of the money he has put into the house

should we get divorced. He wanted to renovate the entire second level, but wants all that money back if we divorce. I have refused, stating that we are married and therefore equal owners. He has subsequently taken all of his parents assets (his father passed early this year) and placed it in a trust controlled by him and only for his family, including our children. I am excluded because I am not a blood relative. He has made it a point to tell me he owns nothing except our house, because he has put everything in this trust. He believes our house is more his than ours, and wants to split the equity only after he gets back all his money. Is this reasonable??

Should You Sign A Post-Nuptial? No. No you should not.

Is This Reasonable? No, No, it does not seem reasonable to me. His actions are not illegal. In fact, the law excludes inheritances from marital property.. So maintaining his family inheritance for his family is well grounded. But is that how you wish to live?

On the Other Hand: Do you recognize your dearly beloved in Dickens’ description of Scrooge?

Oh! but he was a tight-fisted hand at the grindstone, Scrooge! a squeezing, wrenching, grasping, scraping, clutching, covetous old sinner! Hard and sharp as flint, from which no steel had ever struck out generous fire; secret, and self-contained, and solitary as an oyster. The cold within him froze his old features, nipped his pointed nose, shriveled his cheek, stiffened his gait; made his eyes red, his thin lips blue; and spoke out shrewdly in his grating voice. A frosty rime was on his head, and on his eyebrows, and his wiry chin. He carried his own low temperature always about with him; he iced his office in the dog-days and didn’t thaw it one degree at Christmas.

Wake Up and Smell the Coffee! Is this how you wish to live your life? The Law does not have all the Answers. Some you have to figure out on your own. This is one of those questions. Wasn’t that easy?

*************

And Therefore, Uncle Scrooge, Though Christmas Has Never Put A Scrap Of Gold Or Silver In My Pocket, I Believe That It Has Done Me Good, And Will Do Me Good; And I Say, God Bless It!

Must a Successor Trustee make a Distribution-in-Kind of gold coins left in a trust?

My wife’s parents Trust left every thing to their two daughters to be divided equally. Her sister does not want half of the coins, my wife does.

My concern is if the coins which are all identical are are taken in kind that the tax liability may be different than a direct inheritance of the coins. The coins are documented as in the Trust. The cost of valuing the coins is a concern as well. This is in the hands of a 3rd party fiduciary as the daughters don’t get along.

Death and Taxes. Inherited property, like these gold coins, get a special tax benefit. When the property is sold by the trust or transferred to the beneficiary, there is no tax. And property is treated, for tax purposes, as though the beneficiary owner paid fair market value for it on the date of Dad’s death.

Dad Sells His Coins: Dad paid $5 for each gold coin. While alive, Dad sells a gold coin for $10. Now Dad has $5 of profit. Therefore, Dad must pay tax on the profit. Also known as capital gains.

Daughters’ Doubloons. When the trust sells the coins, the trust also has no profit, no capital gain. No tax. Because the trust is treated as if it had paid full fair market value for the coins. The coins were then sold for fair market value. There is no profit. There is no tax. And the tax-free money goes to the daughter who did not want the coins.

Your wife, the other daughter, wants to keep the coins. That’s just fine. No problem and no tax problem. While valuing coins is difficult, it must be done. Write down the value. Get a written appraisal. At some point, your wife will decide that rather than the gold, she would rather have green, folding money.

When she sells, she is treated as if she paid fair market value, back when the last parent died. Even if the value has continued to increase, your wife still pays much less tax.

Dad paid $5 for each coin. Dad dies.

At his death, the coins are worth $10. Daughter (your wife) sells a coin. For $20.

Daughter’s profit is not $15. Daughter is treated as if she had paid $10 for each coin (the value on Dad’s date of death).

Yes, it is complicated. But did you think the government would make it easy for you to keep any part of your stuff? Of course not…

And It Was Always Said Of Him, That He Knew How To Keep Christmas Well, If Any Man Alive Possessed The Knowledge. May That Be Truly Said Of Us, And All Of Us!

And So, As Tiny Tim Observed, God Bless Us, Every One!

Bah,” Said Scrooge, “Humbug.” Why Don’t You Deserve A Little Payback For All The Taxes You Paid In?

Why Do You Want To Spend Your Last Nickel On Long-Term Care?

Why Shouldn’t The Government Spend Your Money For You?

Traditional estate planning is concerned with avoiding probate, saving taxes, and dumping your leftover stuff on your beneficiaries. After you die. Nobody cares what happens to you while you are alive. How does that help anyone? Stupid.

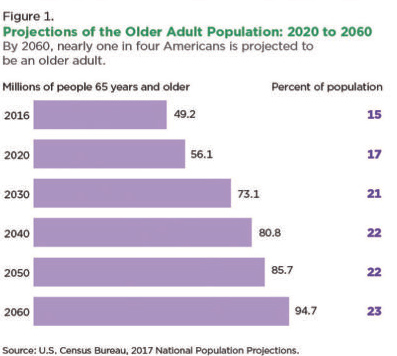

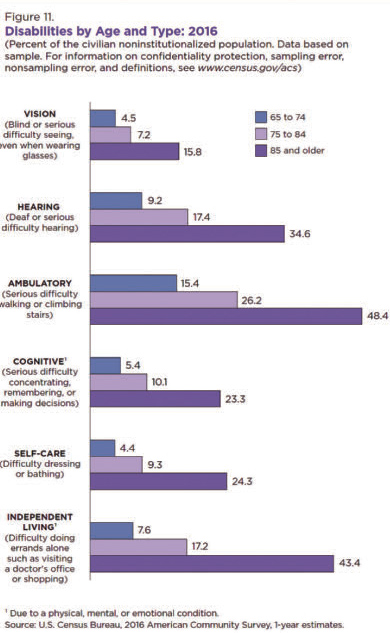

Traditional estate planning fails because the overwhelming majority of us will need long-term skilled care. 70% of us. For an average of 3 years. And we will go broke paying for it.

Is it surprising that thousands of recreation properties: cottages, cabins, hunting land, are lost to pay for long-term care? Why is your estate planner hurting you and your family? It is evil intent? Or stupidity?

LifePlanning™ defeats Nursing Home Poverty. Keep your stuff. Get the care you have already paid for. Good for you. Good for your family. Good example for society.

When my mother suffered from the dementia which led to her death, over 10 years ago, their estate plan preserved their lifesavings. Mom’s months in the nursing home did not mean Dad’s impoverishment. Dad spent the last years with security and peace of mind.

Is Now A Bad Time For A Real Solution?

Perhaps you think you already have an answer to this problem. Maybe you do not see this as a problem at all. It is possible that you do not believe in the passage of time or its effects on you.

Peace of mind and financial security are waiting for everyone who practices LifePlanning™. You know that peace only begins with financial security. Are legal documents the most important? Is avoiding probate the best you can do for yourself or your loved ones? Is family about inheritance? Or are these things only significant to support the foundation of your family?

Do you think finding the best care is easy? Do you want to get lost in the overwhelming flood of claims and promises? Or would you like straight answers?

Well, here you are. Now you know. No excuses. Get the information, insight, inspiration. It is your turn. Ignore the message? Invite poverty? Or get the freely offered information. To make wise decisions. For you. For your loved ones.

The LifePlan™ Workshop has been the first step on the path to security and peace for thousands of families. Why not your family?