Read the Print Version

Clanging For 65 Years!

(Not Edited For Spelling Or Punctuation Or Anything Else) (Warning: Not Legal Advice!)

Though I Speak With The Tongues Of Men And Of Angels, And Have Not Charity,

I Am Become As Sounding Brass, Or A Tinkling Cymbal.

—1 Corinthians 13:1

Question: Would an adult child be responsible for an elderly parents’ nursing home expenses?

A low income, elderlycouple (85+) have been living independently for over 20 years. Their adult child (not an in-state resident ) provided their living expenses for the past 20 years. Due to illness, the adult child is only able to provide very limited living expenses for them.

In 2021, they both were hospitalized due to life threatening illnesses. They do not have any relatives in state and do not have money. At a doctor’s request, adult protection services and some social workers helped them move into a nursing facility due to their low-income status.

One person is qualified for Medicaid. The other one is not.

However, they do not have any money.

The question is, would the adult child be responsible for their elderly parents’ nursing facility medical and living expenses?

Short Answer: Maybe. Most states have filial responsibility laws that impose financial responsibility for parents on the kids. But not in Michigan. Used to be that if your parent wound up in the Kalamazoo Psychiatric Hospital (known at its opening in 1859 as the Michigan Asylum for the Insane), you would get the bill. But not anymore. In Michigan.

Most states do not enforce their filial responsibility laws, but Pennsylvania is an exception. A recent appellate court ruling upheld the constitutionality and enforceability of the law. And Pennsylvania does come after the kids. Sometimes.

Long Answer: Beware when you “sign in” your parent to a nursing home or other facility. At least glance at the papers before you sign them. Better yet, read them. Even better, have your friendly, neighborhood elder law attorney take a gander before you sign.

Back in the day, it was not at all unusual to find a personal guarantee of fees buried in the mound of paperwork that the facility asked you to sign. And people did sign them. And facilities did enforce them. And it was a mess. Which is probably why the practice has pretty much died out. But not entirely, so buyer beware. Or get a little elder law assistance.

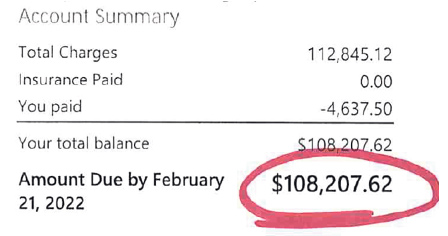

When long-term care costs $200-850/day (that is per day!), can you afford to just sign everything?

Imagine you are placing a loved one in a residential care facility. Do you think it is easy? Easy for the loved one? Easy for you? Most folks get overwhelmed. Crushing need for help and inability to provide care at home. Anger and frustration of the loved one. Guilt and helplessness of the caregiver forced to take this drastic step. And how do we break the promise: “You’ll never to to a nursing home!” Does it matter that you made that promise without knowing the reality of 24-hour, 7-day, 52-week care?

No wonder people sign documents without understanding what they are reading. Perhaps it might be helpful to have someone who has been down this path before…

Question: My boyfriend of 10 yrs just passed and now I got 30 days to get out it just don’t seem right. Is this how it is?

I was working he needed me at home. Before we could look in to caregiving he passed. His sister is 50% on the deed… something like that. So I got 30 days to get out 10 yrs of my life peacefully and she will give me his car and 2500$ I guess that’s the way they do it.

Short Answer: It is harsh to say, but you are probably not entitled to the money or car. Some states have “common law” marriage or “palimony.” In those states, you might have a claim. But not in Michigan.

Long Answer: Seems like sister is “on the deed”, maybe as joint tenant. Since you are definitely not on the deed, you have no title.

Michigan takes a hard line on marriage. Either you are married, with license and ceremony, or you are not. Marriages that were contracted in other states or territories that were valid in those locations are recognized and given effect in Michigan. But that is as far as it goes.

You probably received a 30-day Notice To Quit. This document is the first step in eviction. You may comply and leave, or fight the eviction or force the sister to go through the entire process. There are several ways this could go.

First, you up and leave. You get the car and the money.

Second, you fight. Not sure what basis you have for fighting, so the judge may get annoyed and assess damages for frivolous defenses. Plus you have lost the car and the money.

Third, you insist on every step of the eviction process being followed exactly. This may slow things to a crawl. Or you may get a judge who briskly moves cases through. Eventually, you will be forced to leave. And you may lose the car and money.

Marriage has consequences. Like inheriting property. Like entitlement to spousal share rights. Marriage is not a bed of roses and if it were, you’d find plenty of thorns. But there are benefits to marriage as well. Something to bear in mind.

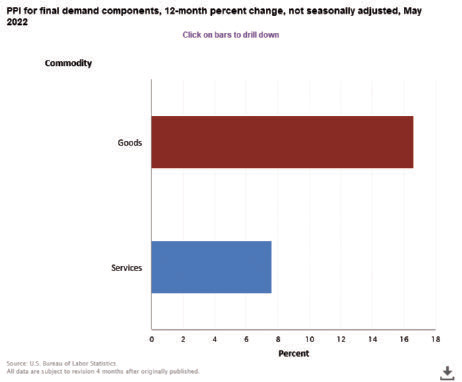

16+% Wholesale Inflation – Again! | 10.1% Cost Of Food Inflation

You Don’t Need A Weatherman To Know Which Way The Wind Blows

Nostalgic For The Good Old Days Of Jimmy Carter? Me Too.

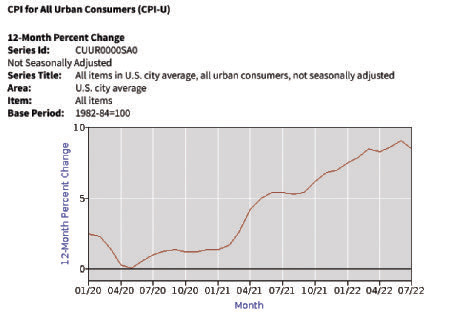

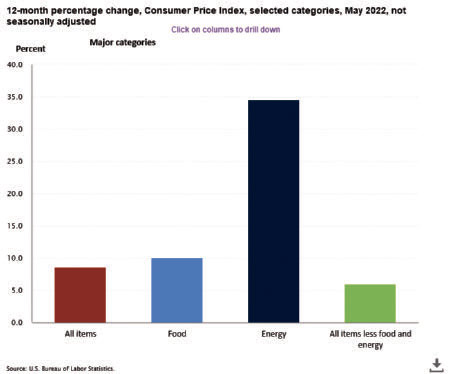

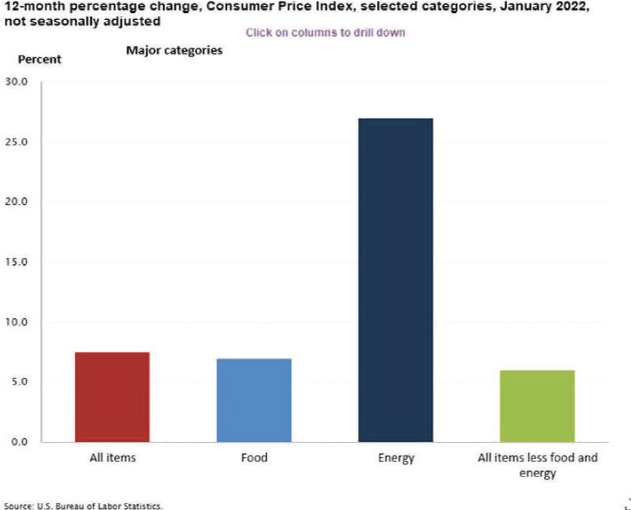

More good news from our friends at the Bureau of Labor Statistics! Consumer Price Inflation is setting new 40-year records. Again.

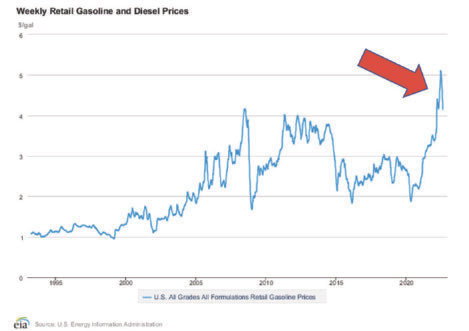

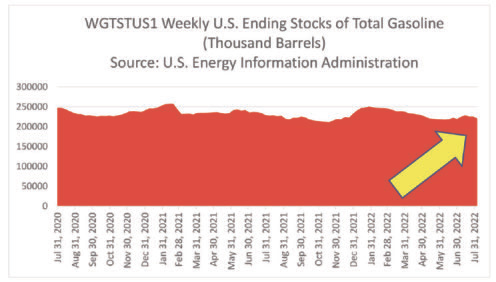

Energy prices are up. Way, way up. And that’s easy to solve. Simply stop driving anywhere. Stay at home. Problem solved.

Now that summer is finally here, you may wish to turn on your air conditioning. Do not. Your cost of cool is up 35%. Fortunately, sweat is still free. And it is all natural. Probably gluten-free, too. So, stay home, in the dark, with the air conditioning off. It is the New American thing to do.

Also, you can forget about going to the pool. No lifeguards. According to that paragon of virtue, National Public Radio: “the National Recreation and Parks Association says 8 out of 10 parks and rec departments can’t find enough staff.” “Tens of thousands of pools across the country are closed…”

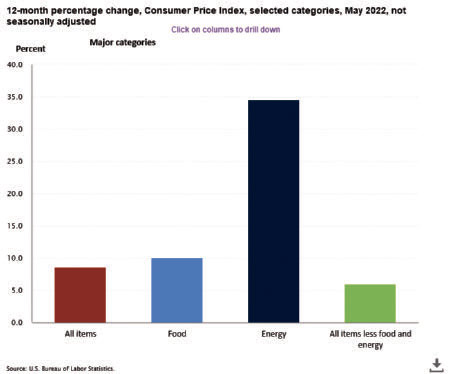

Everybody complaining about gas prices. Is that the worst? No. Gas prices are not the worst part. So what is the worst? Since you have not read or heard it anywhere else, it falls to your Elder Law Reporter to point out the worst. Food Inflation. Food Inflation is in double-digit territory. Food costs 10.1% more now. You can stay home and save gas. Can you stay home and not eat? For how long?

Little Orphan Annie said, “The sun’ll come out tomorrow, bet your bottom dollar that tomorrow, there’ll be sun!”

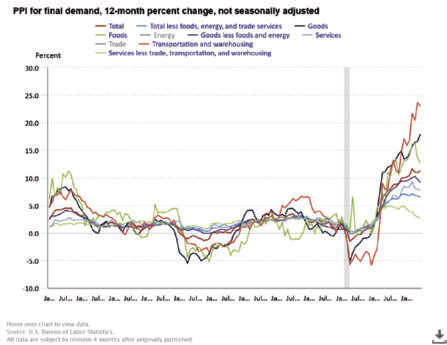

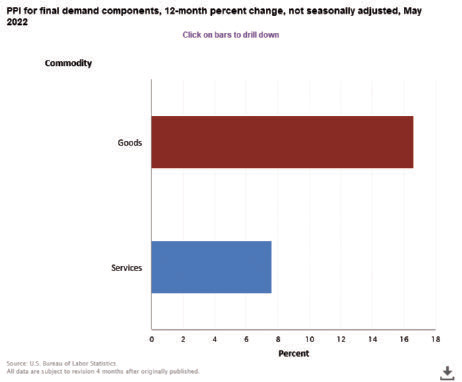

Little Orphan Annie has not been watching the Producer Price Index.

Every time you go to the store, you experience the Consumer Price Index. The CPI is how the government measures misery today.

Future pain is predicted by the Producer Credit: Pacific Comics Club Price Index. The PPI measures wholesale inflation, before it gets to your local store. Wholesale inflation is once again at a 40-year high. 16.6%.

Did you think 10% Food Inflation was bad? How about 16.6%?

That is what’s coming tomorrow.

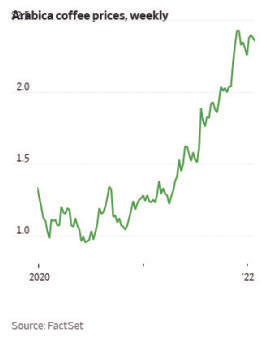

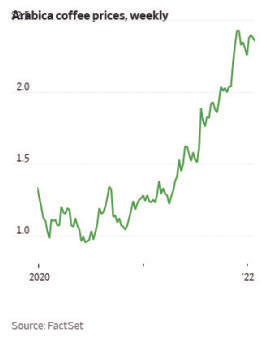

Hey Annie! Wake up and smell the coffee! Whoops, according to the Wall Street Journal, thanks to “extreme weather and supply-chain disruptions,” we have a coffee shortage and prices are up 76%. Yeah, we got a chart for that.

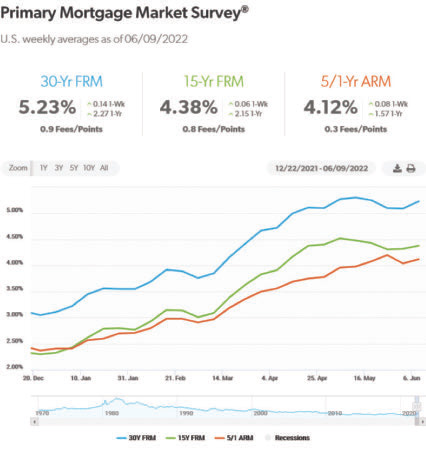

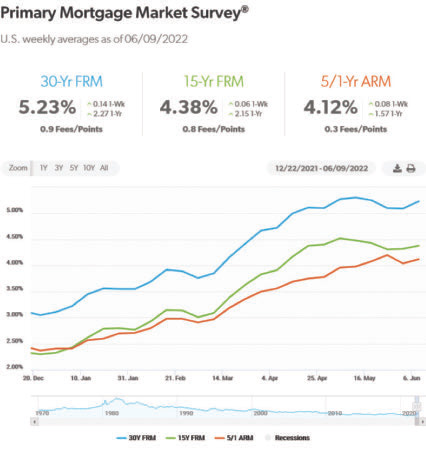

Homebuyers! Do not feel left out. Home mortgage interest rates are still climbing, according to Freddie Mac (formerly known as the Federal Home Loan Mortgage Corporation):

Investors! Guess what… the market is tanking. Down 17% this year. So far. But you already knew that.

What’s It All About? Six Keys To Happiness

How do you survive when the best-case scenario is: Horrifically Worse Than Jimmy Carter, But At Least No Thermonuclear War? Follow the Six Steps:

Stay home. Do not move about. Do not turn on the A/C. Do not eat. Do not buy another house. Do not look at your investments. Easy!

Is traditional trust planning failure a scam…

Your Estate Plan Is A Death Trap

Or Can It Be Explained By Incompetence And Indifference?

Traditional estate planning is supposed to avoid probate, save taxes, and dump your leftover stuff on your beneficiaries. After you die. Nobody cares what happens to you while you are alive. How does that help anyone? Stupid.

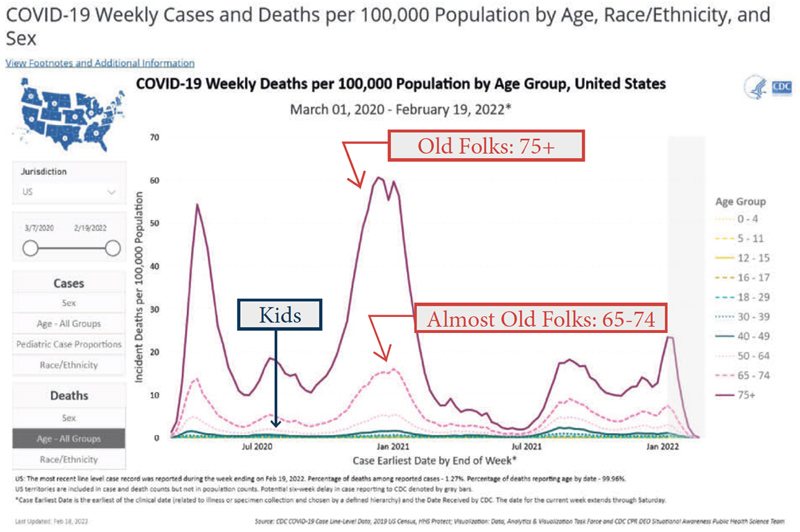

Traditional estate planning fails because the overwhelming majority of us will need long-term skilled care. 70% of us. For an average of 3 years. And we will go broke paying for it.

Is it surprising that thousands of recreation properties: cottages, cabins, hunting land, are lost to pay for long-term care? Why is your estate planner hurting you and your family? It is evil intent? Or stupidity?

LifePlanning™ defeats Nursing Home Poverty. Keep your stuff. Get the care you have already paid for. Good for you. Good for your family. Good example for society.

When my mother suffered from the dementia which led to her death, over 10 years ago, their estate plan preserved their lifesavings. Mom’s months in the nursing home did not mean Dad’s impoverishment. Dad spent the last years with security and peace of mind.

Is Now A Bad Time For A Real Solution?

Perhaps you think you already have an answer to this problem. Maybe you do not see this as a problem at all. It is possible that you do not believe in the passage of time or its effects on you.

Peace of mind and financial security are waiting for everyone who practices LifePlanning™. You know that peace only begins with financial security. Are legal documents the most important? Is avoiding probate the best you can do for yourself or your loved ones? Is family about inheritance? Or are these things only significant to support the foundation of your family?

Do you think finding the best care is easy? Do you want to get lost in the overwhelming flood of claims and promises? Or would you like straight answers?

Well, here you are. Now you know. No excuses. Get the information, insight, inspiration. It is your turn. Ignore the message? Invite poverty? Or get the freely offered information. To make wise decisions. For you. For your loved ones.

The LifePlan™ Workshop has been the first step on the path to security and peace for thousands of families. Why not your family?

NO POVERTY. NO CHARITY. NO WASTE.

It is not chance. It is choice. Your choice.

Get Information Now. (800) 800317-2812