Middle Class Families Go Broke Because “Experts” Broke Estate Planning

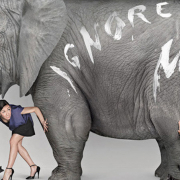

Elephants In The Room

Ever go to the zoo? Remember the Elephant House? Couple of big ole elephants in there… Elephants doing what comes naturally. Smelled strong, right? Tough to deny there is an elephant (or two) nearby. You can hear them breathing… moving around.

Now, if an elephant is sharing a room with you, wouldn’t that be significant? I tend to think it would be an important fact, don’t you? It is possible, perhaps, you would want to deal with your companion somehow. Well, I suppose you could pretend that there is no elephant. But wouldn’t that be foolish? Dangerous, even. Not good. You might step in something. Something might step on you. Either way… Squish!

Let us say you figured this one out. Using your five senses, plus common sense. Do you really need Sherlock Holmes, Columbo, or MacGyver for this one? And yet, various people, who claim to be experts, are trying to tell you there are no elephants. These people covered up the elephants with bedsheets. They talk about everything else. Minor stuff. Distractions. Everything except what is most important. But you cannot hide an elephant with a bedsheet! Yet they try. Why? What is going on here?

Long Term Care – The Biggest Elephant In The Room

What is the problem? Middle-class families go broke. All the time. Routinely. It is accepted and acceptable to the so-called experts. I think it is horrible. To work for a lifetime, saving, scrimping, economizing. And watch it all vanish in a matter of months. A nightmare.

“Do not worry!” say the experts, as they try to cover up that elephant. Trying to convince you that probate or interest rates or inflation or taxes are the “real” problem. Long-term care, they say, is something that happens to someone else.

I am no great fan of government information. But even a blind squirrel gets lucky sometimes. Here are a few chestnuts from the federal Department of Health and Human Services. At www.LongTermCare.gov, quoting:

- Someone turning age 65 today has almost a 70% chance of needing some type of long-term care services and supports in their remaining years

- Women need care longer (3.7 years) than men (2.2 years)

- One-third of today’s 65-year-olds may never need long-term care support, but 20 percent will need it for longer than 5 years

You worked. You saved. You planned for your retirement. Time to relax. Travel. Spoil the grandkids. Not so fast. Not if you are like 70% of folks. You will probably need long-term care services for years. And leave your spouse destitute. And your legacy is…?

By ignoring the biggest, noisiest, smelliest elephant in the room, the burden of your care falls (like a ton of bricks) on your loved ones. If the caregiver is your spouse, they are as likely to die first as you are. Stressed out. Exhausted.

And the experts ignore all this. They want you to think that the real problem is how your kids get your stuff. As if there will be any stuff to get.

Yank the bedsheet off the elephant. Face the facts. Do not let fast-talkers distract you from the reality. Long-term care is the future for most of us. How are you going to deal with it?

Does It Matter To You? The Rich, The Poor, The Middle Class

Not everyone needs to worry about long-term care. Of the three large groups of Americans, only one really must be concerned. The Big Three are: The Rich, The Poor, The Middle Class.

Devastating Gut Punch. The Middle Class

Husband with some dementia. You can manage. Not much sleep. Stressful. But you can manage. Unfortunate fall. Broken hip. Hospitalization. Rehabilitation. Thank goodness for Medicare! And that Medicare Supplement insurance. Minimal out of pocket expense. Three weeks in rehab. Coming home? No.

You could barely handle him before. Now it is out of the question. He needs skilled care. At least for now… maybe he will get better… But Medicare is done. Insurance will not pay anymore. Now it is on you.

Letter in the mailbox. Looks like a bill. Return address: Nursing Home. First six weeks. $18,327. plus, tax. Your head hurts. You almost vomit. You have never seen a bill for this much. You have not spent $18,000 since you bought the house… What are you supposed to do? Better sit down. Quick.

It Don’t Matter To Me… The Rich, The Poor

The Rich. Your spouse transferred from rehabilitation to long-term care at the nursing home. The first bill came in today’s mail. Eighteen thousand dollars. Well. You did not think it would be cheap… actually pretty reasonable when you think about it. So, which account should you pay it from? The money market? Regular checking? Should probably ask the financial advisor… looks like this long-term care will be almost as expensive as maintaining the summer cottage and the ski condo, combined! Not counting the sailboat, jet skis or the golf cart, of course, let alone the horse boarding…

The Poor. Could not pay for the groceries without the Section 8 subsidized housing. Husband now in skilled nursing. How will you ever get transportation to visit? Hope there’s a bus line around there somewhere. Looks like a nursing home bill in the mail. Wow. That place is expensive! Eighteen thousand… and that’s just for the first six weeks. Sigh. Just put it on the stack with the other bills you cannot afford to pay. Have to prioritize… heat and groceries first. Good to know that with skilled nursing, his care is guaranteed. Even without Medicare or Medicaid or Medi-whatever, he will get the care he needs.

Long-Term Care Reality. Rich Man, Poor Man

It can be uncomfortable to look under the bedsheet and take a good hard look at the elephant everyone else is trying to hide. I do not apologize for that. Sometimes truth is not pretty. Facts can be inconvenient.

It is simply true that if you are wealthy, long-term care costs are manageable. You do not need me. Plenty of folks downtown in glass towers with expensive suits and ties are just dying to meet you. Original, incomprehensible art on the wall. Park in the ramp, bring your ticket for validation. Plan for long-term care or do not plan for long-term care, you are not going broke. Let those guys worry about your excess profit’s taxes, capital gains and all that…

It is also true that many families simply cannot begin to pay the costs of long-term care. A bill for $1200 is as much out of their reach as a bill for $12,000. And at that point, what does it matter? You cannot pay anyway. Social security cannot be taken from you. You will not be denied your housing assistance. Bills piling up are awful. Stressful. But at the end of the day, care will be given. Your personal property will not be taken. I cannot help you to preserve assets you do not have.

NOTE: The Medicaid system is extremely complex, with many variables, hurdles and hoops. It is not unusual for Medicaid to be denied to people who should qualify for benefits, often for technical reasons. Over the years, we have helped many such families resolve these issues and get the benefits. From time to time, we work with skilled nursing facilities to get the compensation they have earned by helping these families meet the legal requirements.

LifePlan™ Salvation For The Middle-Class

The rich do not need me. The poor I cannot directly help. That leave the middle-class. It is the middle-class savers, workers, builders that I can help. You get that bill: your guts turn to water, you are about to puke, and you are desperately searching for a place to sit down. Relax! Your LifePlan™ will take care of it. You saw the signs: 70% need long-term care services. One in Five need long-term care services for more than five years. You rejected nursing home poverty. You choose the path of reasonable optimism, while guarding against the potential downsides. Hope for the Best, Plan for the Worst.

The LifePlan™ approach is the least expensive, most effective solution to the harsh reality of long-term care. You opened your eyes when faced with long-term care costs. Accepted reality. Refused to allow your lifesavings evaporate like a snowflake on a hot griddle. Recognized the reality of the caregiver spouse dying first, almost half the time and fixed it. Rejected nursing home poverty.

Never Too Late

Sitting there with the nursing home bill in your hand, you say, “Coulda, shoulda, woulda… And now it is too late! Maybe that LifePlan™ Workshop or Webinar would have been a good idea.”

It is never too late. There is nothing inevitable about losing your home, cottage, business, lifesavings, independence. Planning is the best route, but not the only one. Even if the dementia diagnosis was your wake-up call. Even if your attention was finally focused by the slip and fall broken hip. Do not give up the ship! It is never too late for you to be the hero… to fight and win!

Not Chance, Your Choice. Uncover The Elephant!

There is nothing inevitable about nursing home poverty. Peace of mind and security are waiting for you. Right now. It is a choice. Despite what “everybody else” says. Despite their attempts to disguise the elephants in the room. For over thirty years, people have told me, “I’ve never heard of this before!” “If this is real, why doesn’t everyone do it?” “My lawyer/financial advisor/brother-in-law/accountant/tax person/banker/best friend/fill-in-the-blank never said anything like this…”

Well, here you are. Now you know. No excuses. Get the information, insight, inspiration. It is your turn. Ignore the message? Invite poverty? Or get the freely offered information. To make wise decisions. For you. For your loved ones.

No Poverty. No Charity. No Waste.

It is not chance. It is choice. Your choice.

Leave a Reply

Want to join the discussion?Feel free to contribute!