Latest Federal Government Numbers Confirm. Let’s Stop Arguing, It’s Obvious

Bureau Of Economic Analysis Department Of Commerce

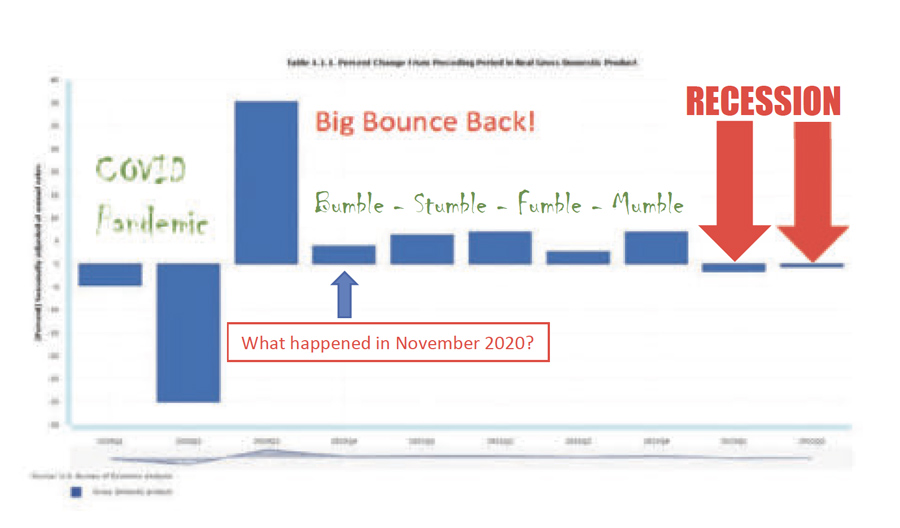

A picture is worth a thousand words. Recession is when your neighbor loses his job. Depression is when you lose yours. Recovery is when grifting politicians lose theirs. This is the most predictable recession in history. Everybody knows that when America displays weakness, things get out of hand. In Europe. In the Middle East. No surprise. Everybody knows that when you print trillions of dollars, you get inflation. When you promise to wave a magic wand and make hundreds of billions of dollars in loans just… disappear, you demoralize everyone who played by the rules. And cause more inflation. We can all see that when prominent politicians try to criminalize other Americans, based on their political views, you get strife. And we all know that if there is no consequence to crime, we will all get a lot more crime.

Is it ridiculous to protect yourself and your family first? How can the government command respect when it fails in its most basic obligations: security, peace, safety? Is this a bad time to stop kidding ourselves? Is now too soon to restore some sanity? If not now, when? If not you, who?

Government Newspaper, Washington Post, Supports Government

Don’t Worry — Recession Is Good! — Be Happy

In Other News: Dog Bites Man

Once upon a time, newspapers and the government had a healthy rivalry.

Civil War General William Tecumseh Sherman was clear. ““I hate newspapermen. They come into camp and pick up their camp rumors and print them as facts. I regard them as spies, which, in truth, they are. If I killed them all there would be news from Hell before breakfast.”

First Amendment Founding Father Thomas Jefferson was equally blunt. “Nothing can now be believed which is seen in a newspaper. Truth itself becomes suspicious by being put into that polluted vehicle.”

Today of course, great, metropolitan newspapers, like the Washington Post, bravely toe the party line. Providing cover for clownish political poltroons who cannot remember what they are doing in the room or how to get off the stage…

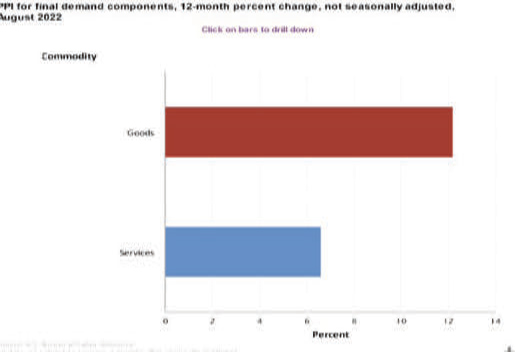

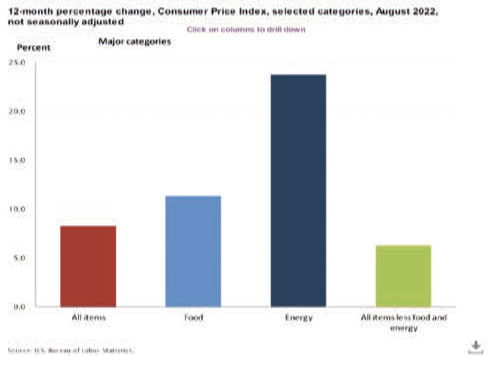

Would it make you happy to know that devastating recessions have seven (7) silver linings? Your retirement has been gutted. Your shopping cart is empty. Your grandkids would not know what to do with a job if it bit them on the behind. Inflation is up. Gross Domestic

Product shrinks. Then, just as you were feeling a little stressed, the Washington Post pops up with a timely tale worthy of Shakespeare!

Forget about 7 Deadly Sins, 7 Brides for 7 Brothers, or the Magnificent Seven… Here are:

7 Silver Linings To The Recession

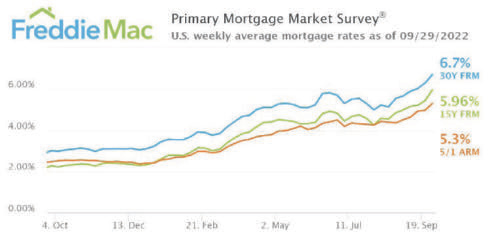

1. Housing prices may finally come down to reasonable levels. Interest rates have skyrocketed for six straight weeks so you won’t be able to afford the monthly payment. And there’s No Money Left Behind after you pay for groceries, but lookit that low low price!

2. Savings rates are up. Your inflated, wall- paper dollars don’t buy anything anymore. So, you may as well save ‘em!

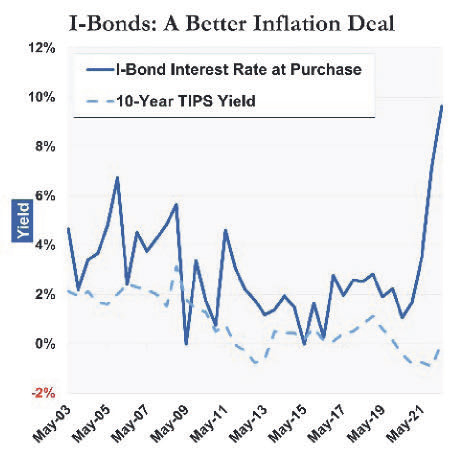

3. I bonds interest rate might go even higher. I Series Savings Bonds adjust the interest rate for inflation. There’s been so much inflation, the interest rate is high as an elephant’s eye. Almost as high as inflation. Ha ha, you still lose.

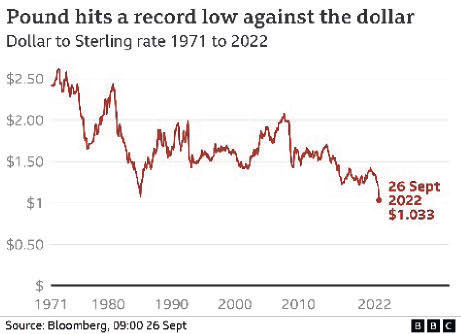

4. The dollar is king. Inflation is high. Interest rates are high. The U.S. Dollar exchange rate is high. Now you can go visit the King. In England. So cheap! And you have plenty of time to go. Dollars are so expensive, no one can afford “Made In America” stuff. So you are out of a job. Cheerio!

5. Unemployment is still relatively low. More kids living at home with Mom and Dad. And enjoying it. Fewer workers. Same jobs. Lower unemployment.

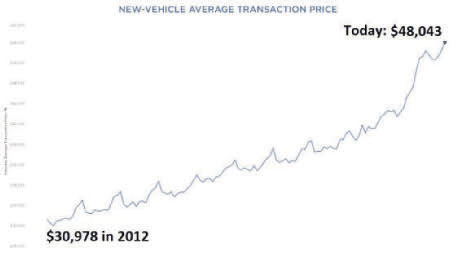

6. Your used car is worth more. Hope you like your old clunker! The average cost of a new car is $48,043. So you ain’t getting’ one! Thank you, Kelly Blue Book.

7. Student loan forgiveness is coming. Another Trillion Dollar giveaway from the working people of America to the pot-smoking, latte-sipping, firebomb-throwing misfits who turned college into an 8-year vacation. Why shouldn’t it be free?

Why Don’t You Deserve A Little Payback For All The Taxes You Paid In?

Why Do You Want To Spend Your Last Nickel On Long-Term Care?

Why Shouldn’t The Government Spend Your Money For You?

Traditional estate planning is concerned with avoiding probate, saving taxes, and dumping your leftover stuff on your beneficiaries. After you die. Nobody cares what happens to you while you are alive. How does that help anyone? Stupid.

Traditional estate planning fails because the overwhelming majority of us will need long-term skilled care. 70% of us. For an average of 3 years. And we will go broke paying for it.

Is it surprising that thousands of recreation properties: cottages, cabins, hunting land, are lost to pay for long-term care? Why is your estate planner hurting you and your family? It is evil intent? Or stupidity?

LifePlanning™ defeats Nursing Home Poverty. Keep your stuff. Get the care you have already paid for. Good for you. Good for your family. Good example for society,

When my mother suffered from the dementia which led to her death, over 10 years ago, their estate plan preserved their lifesavings. Mom’s months in the nursing home did not mean Dad’s impoverishment. Dad spent the last years with security and peace of mind.

Is Now A Bad Time For A Real Solution?

Perhaps you think you already have an answer to this problem. Maybe you do not see this as a problem at all. It is possible that you do not believe in the passage of time or its effects on you.

Peace of mind and financial security are waiting for everyone who practices LifePlanning™. You know that peace only begins with financial security. Are legal documents the most important? Is avoiding probate the best you can do for yourself or your loved ones? Is family about inheritance? Or are these things only significant to support the foundation of your family?

Do you think finding the best care is easy? Do you want to get lost in the overwhelming flood of claims and promises? Or would you like straight answers?

Well, here you are. Now you know. No excuses. Get the information, insight, inspiration. It is your turn. Ignore the message? Invite poverty? Or get the freely offered information. To make wise decisions. For you. For your loved ones.

The LifePlan™ Workshop has been the first step on the path to security and peace for thousands of families. Why not your family?