Happy Talky Talky Happy Talk! Don’t Worry, Be Happy

HOW ARE MORTGAGE RATES LIKE MURDER RATES?

Ever wonder how mortgage rates are like murder rates? Me too! And we are in luck. You have paid so much in taxes; Washington bureaucrats track this stuff. Not joking.

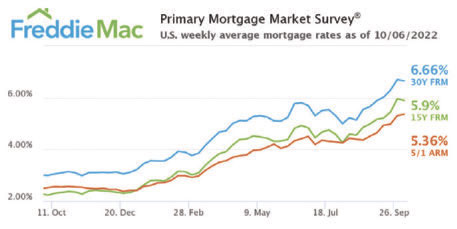

Freddie Mac (not the guy with the hamburgers or cheesy macaroni) says home mortgage interest rates have almost tripled. USA, USA, USA!

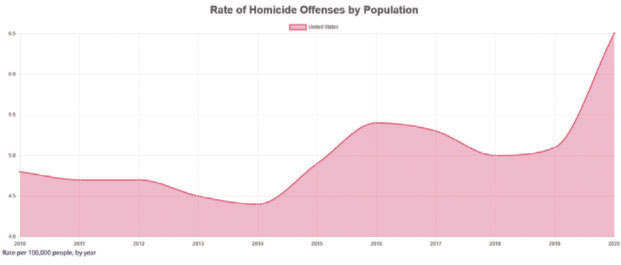

The American Stasi, Gang That Couldn’t Shoot Straight, Praetorian Guard, Federal Bureau of Investigation, Crime Data Explorer, reports that murder rates are surging. How did that happen?

Don’t believe me… believe your own lying eyes:

Federal Bureau of Investigation, Crime Data Explorer

What’s The Difference Between Oil And Murder Plus Mortgage Rates?

Why would the Leader of the Free World™ grovel to Petroleum Potentates? Why would Petroleum Potentates wipe the Leader of the Free World™’s nose in his stinky economic and geopolitical mess? Why would PPs listen to the L of the FW’s humiliating pleas, then do exactly the opposite? Because they can. But why? How?

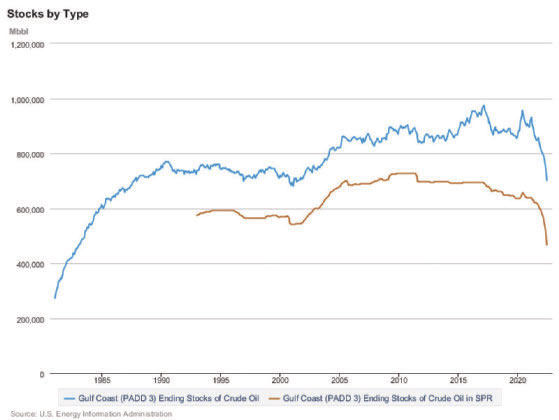

Your tireless tax-paid government bureaucrats at the U.S. Energy Information Administration have the answer. In a single chart.

Follow the lines. “Ending Stocks of Crude Oil” in our Strategic Petroleum Reserve (SPR) are at a 30-year low. Thirty. Year. Low. From historic highs to historic lows. In 2 years. Did somebody try to buy political favors with your energy security? Nah! Crazy talk. Conspiracy theory. I am sure there is a very good explanation. Very. Good.

What else is at historic lows? America’s regular stocks of crude oil. Lowest in 30 years for “Ending Stocks of Crude Oil”. Blame COVID. Or Russia. Or China. Or Ukraine. Or Evil Oil Companies. Or Garden Gnomes. Right? Could not possibly have anything to do with doddering grifters wrapping themselves in the flag and buying votes. Nah! So much crazy talk.

And thank goodness for global warming! Our planet is so toasty, we don’t need petroleum products to heat our homes. Nowadays, winter is a thing of the past. A few old greybeards remember snow as a distant memory, but you’ve never seen any. And windmills juice up all our electric rent- a-cars. No problem. Don’t worry. Be happy. Now.

Murder Up! Mortgage Up! Oil Supply Down!

What are you going to do about it?

Lightning Letters Redux…

Like Sands Through The Hourglass… So Are The Letters Of Our Lives

(Not Edited For Spelling Or Punctuation Or Anything Else) (Warning: Not Legal Advice!)

Bad Ideas Come From Bad Information

How do I put my name on my mom’s property?

We are living with my mom to take care of her. She has dementia and may need to go into a home. Her will already states that I get everything as my sister and father passed away. I know if I try to put her into a home to help her, we will have to sell the house and we don’t want to lose it and be homeless.

The Short Answer Is: You don’t. Bad idea. Putting your name on mom’s property now would be a “divestment” for Medicaid purposes. If mom needs a Skilled Nursing Facility, she won’t get help, she’ll get a penalty period. And then she’ll get sued. And then they’ll sue you. And then you’ll lose the homestead. And that would be bad.

The Longer Answer Is: Plan to avoid probate. Mom can keep her homestead. You can live in and maintain it. Mom still gets her Skilled Nursing Facility benefits. Although Medicaid takes all her income except for $60/ month.

The Problem Will Be: House in mom’s name must go through probate at death. That’s bad: 1 – Mom gets Medicaid. 2 – Mom dies. 3 – Mom’s estate, including the house, gets probated. 4 – State of Michigan wants its Medicaid money back. State shows up in probate court. State gets the dough. 5 – You lose the house. 6 – You are homeless. Bad.

The Good Answer Is: Avoid probate with a Transfer- On-Death Deed, also known as the Ladybird Deed, Enhanced Life Estate Deed, or Deed pursuant to Michigan Land Title Standards Act 9.3.

A Potential Pitfall: Many folks use the TOD Deed to transfer the house to themselves directly. Now you go bankrupt or get sued or divorced or need long-term care and pfffft goes the house. Waste of Golden Opportunity for long-term security. You are getting the house for free. Mom’s care is also free (except she paid for it through years of income tax). Do Not Cheap Out Now. Spend a couple bucks and secure the house forever. And ever. Amen. (Yes, this strategy uses a trust. Get over it.)

Is Blood Thicker Than Water? And How Could You Tell?

Trust vs Heirs?

Dear attorney, there is an elder lady, who wants to put her niece to Trust and wants this niece to be an owner of this house when she dies. At the same time this lady has 2 sons, who might want to claim to get this property after their mother passes away. In that situation, in case her sons claim this property as blood heirs, what would prevail: trust or rights of her sons as blood relatives? What if they launch a court process, are there any theoretical chances to get the property in possession of her sons? Thank you in advance!

The Short Answer Is: Elder Lady Auntie gets to do with her stuff what she wants. Suggest using a trust to keep it out of probate. Quicker, faster, better. Less opportunity for uncles to complain. Trust wins over Blood! But.

The Longer Answer Is: Why is Elder Lady Auntie sweet on Nice Niece to the point of disinheriting her flesh-and-blood? Millions of reasons. But. Do you want uncles (father?) claiming that Nice Niece “unduly influenced” Elder Lady Auntie? I betcha NN is helping care for ELA. I betcha they are very close. I betcha ELA’s powers of attorney/will/trust/patient advocate name NN as ELA’s fiduciary. Danger is real, not a “theoretical chance.”

The Problem: NN’s close relationship with ELA means NN automatically unduly influenced ELA to give House to NN. (This is known as shifting the burden of proof.) Now NN must prove NN did NOT unduly influence ELA. Which is impossible now that ELA has died. NN loses house. Uncles win. Angels weep.

The Good Answer Is: Employ experienced counsel. Do it correctly. Wise, foresighted counsel will anticipate the undue influence claim. And defend against any such challenge. And a bunch of other stuff that can go haywire.

Why Don’t You Deserve A Little Payback For All The Taxes You Paid In?

Why Do You Want To Spend Your Last Nickel On Long-Term Care?

Why Shouldn’t The Government Spend Your Money For You?

Why Does Traditional Estate Planning Fail? All the time

Traditional estate planning is concerned with avoiding probate, saving taxes, and dumping your leftover stuff on your beneficiaries. After you die. Nobody cares what happens to you while you are alive. How does that help anyone? Stupid.

Traditional estate planning fails because the overwhelming majority of us will need long-term skilled care. 70% of us. For an average of 3 years. And we will go broke paying for it.

Is it surprising that thousands of recreation properties: cottages, cabins, hunting land, are lost to pay for long-term care? Why is your estate planner hurting you and your family? It is evil intent? Or stupidity?

LifePlanning™ defeats Nursing Home Poverty. Keep your stuff. Get the care you have already paid for. Good for you. Good for your family. Good example for society,

When my mother suffered from the dementia which led to her death, over 10 years ago, their estate plan preserved their lifesavings. Mom’s months in the nursing home did not mean Dad’s impoverishment. Dad spent the last years with security and peace of mind.

Is Now A Bad Time For A Real Solution?

Perhaps you think you already have an answer to this problem. Maybe you do not see this as a problem at all. It is possible that you do not believe in the passage of time or its effects on you.

Peace of mind and financial security are waiting for everyone who practices LifePlanning™. You know that peace only begins with financial security. Are legal documents the most important? Is avoiding probate the best you can do for yourself or your loved ones? Is family about inheritance? Or are these things only significant to support the foundation of your family?

Do you think finding the best care is easy? Do you want to get lost in the overwhelming flood of claims and promises? Or would you like straight answers?

Well, here you are. Now you know. No excuses. Get the information, insight, inspiration. It is your turn. Ignore the message? Invite poverty? Or get the freely offered information. To make wise decisions. For you. For your loved ones.

The LifePlan™ Workshop has been the first step on the path to security and peace for thousands of families. Why not your family?