Money, Money, Money

If There’s So Much Of It, Why’s It So Hard To Get? Or Keep?

We Stand On The Shoulders Of Giants

Americans save billions of dollars every year. About 400 billion dollars. Americans receive gifts and inheritances worth billions of dollars every year. About 400 billion dollars. Says who? Says the Federal Reserve Board of Governors. Don’t believe me, look it up: https://www.federalreserve. gov/ econres/ notes/ feds- notes/ how- does- intergenerational-wealth-transmission-affect- wealth-concentration-20180601.html

Did you know that Americans receive gifts and inheritances worth about as much as they save for themselves? Me neither.

What does that mean right now?

Simple. Half of American families’ financial stability comes from their extended family. Mom and Dad. Grampa and Grandma. Gifts while they are living. Inheritances when they die. Family members looking out for family members. Blood thicker than water. Charity starts at home.

A Warning! In the immortal words of James Whitcomb Riley, in his classic Little Orphan Annie, from 1885:

An’ one time a little girl ‘ud allus laugh an’ grin, An’ make fun of ever’one, an’ all her blood an’ kin; An’ onc’t, when they was “company,”

an’ ole folks was there,

She mocked ‘em an’ shocked ‘em, an’ said she didn’t care!

So, go ahead and share your bold judgments and woke opinions. Turn Thanksgiving into Clash of the Titans. Annoy your relatives at Christmas. Make fun of Easter and the 4th of July. Demonize George Washington and Thomas Jefferson. Don’t worry about alienating the folks who will likely give (that’s G-I-V-E) you as much as you will save for yourself…

Long-Term Care Breaks The Giants

Today, older folks are living longer than ever before. That means more will need long-term care than ever before. Greater Demand.

Today, there are fewer younger folks than there used to be. That means not so many are available to provide long-term care. Lower Supply.

What happens to Prices when Demand goes UP and Supply goes DOWN? Hint: Prices skyrocket.

When Grandma has spent $15,000 per month for years on Grampa’s skilled nursing care, how much is left over to help the kids and grandkids? Hint: Not much.

Who Pays When The Giants Go Broke?

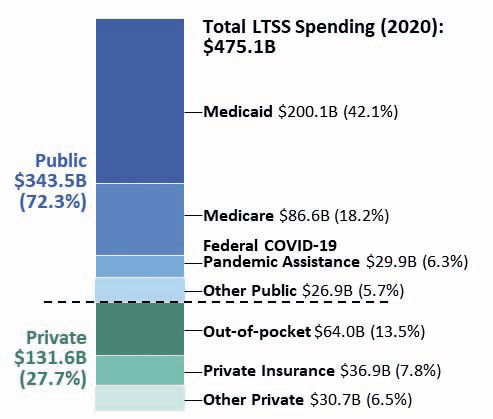

The truth is that you, the Giants, the taxpayers, have already paid. Through Medicaid and other taxpayer-supported programs, you are footing the bill for your own long-term care, as well as care for everyone else. About three-quarters of all “Long- Term Services and Supports” (LTSS) are paid for by your tax dollars. Not kidding.

According to the Congressional Research Service, here’s how that breaks down:

Long-Term Services and Supports (LTSS)

Spending, by Payer, 2020

(in billions)

Source: CRS analysis of National Health Expenditure Account (NHEA) data obtained from the Centers for Medicare & Medicaid Services (CMS), Office of the Actuary, prepared December 2021. Notes: Analysis includes Medicare post-acute care spending in an expanded definition of LTSS spending. Percentages may not sum to 100% due to rounding.

Help The Giants Stand Tall

Do you like to pay for the same thing twice? Would it be a bad thing to get some benefit back from the taxes you pay in? Is it wrong to support your family members and relations as you choose?

Is it possible to live the life you have earned? Can you be the Giant that sets your family apart? Can you carry on the American tradition of self- reliance and vital family relationships? Why not? All it takes is a little foresight and planning. Planning that you thought was impossible except for the very wealthy. Planning that you thought was financially out of reach. What if that kind of planning was available to you? And affordable for you?

Have you given up on your own American Dream? Would it be a ridiculous waste of an hour or two to find out?

Get All You Need: Estate Planning Is Like Flying

Take the airlines. Back in the day, few people flew. Go Greyhound! Dress Code was suit and tie. Or a nice dress. Airline travel was for the few, the proud, the wealthy. It was not for you, except at great financial sacrifice. But golly, was it nice!

Today, we like to complain about getting packed in like cattle. The seats are smaller. Everything costs extra. People show up in their pajamas. (And if those aren’t pajamas, I’d like to know what you call ‘em!) Golly, it is just not so nice anymore!

On the other hand, if you want to go to Florida, today you have many choices. Even among the least expensive airlines. Fly to Florida, direct from home, with no connecting flights. Nonstop! $59 round trip! Amazing. The seat doesn’t recline. No free soda. No free peanuts. There are no movies. You pay extra for everything, but you only pay for the things you want.

You can still get dressed up if you want. If you really like being served lunch or dinner at 40,000 feet, sign up (and pay) for first class. Finally, if you are determined to burn through your life savings, why not fly in a private jet? For less than $60,000, I’m told you can fly round trip from Miami to Grand Rapids. If you want to.

Get What You Need At A Price You Can Afford

Something you already know about air travel. It is safe. Super safe. You are safer in the airplane way up high in the sky than when you are driving home from the airport. True fact.

You are as safe with your $59 ticket as you are with a $59,000 private jet. Plus, both options will get you to Orlando to visit the Mouse. And safely back home again. More simple truth.

Schedule, price, amenities… these sorts of decisions are now left to the airlines, and you, to decide. What do you value? Make your decision. That’s the American Way!

Do you suppose more choices at lower rates would inspire more Americans to fly? According to the Bureau of Transportation Statistics (your tax dollars at work) airline travel exploded after deregulation! In 1975, before the airlines were set free to serve you, almost 197 million of your fellow Americans. Within 10 years that number practically doubled, to 363 million air travelers. By 2019, almost 5 times as many Americans enjoyed squeezing into little seats, listening to a safety briefing, and jetting off to their dream destination.

All these choices can be confusing. But do you want to surrender? Do you really want to go back to the old way of doing things? I didn’t think so.

Don’t Pick And Choose… Get Everything

Price Reduced By 50-66%

What if you could have it all? Asset Protection. Long-term Care Protection. Full funding of your trust. Access to live counsel. Secure assets for yourself, your spouse, your family. Avoid Probate. Save Taxes. Protect Leftovers for the kids.

If you want the old-fashioned, more expensive one-on-one process… great! We are not giving that up.

On the other hand, if you want all the results, at drastically reduced fees, perhaps you might consider a series of live and video meetings with other folks just like you.

1. In person: The LifePlan™ Workshop – No change; Stick with what works.

2. In person: The Blueprint Design – Together with the other folks from your LifePlan™ Workshop, you complete a confidential workbook with detailed information about yourself and your family. Your hopes and dreams. You commit and pay ½ of the reduced fee.

3. Zoom Meeting: One-on-one Review Meeting with Your Counsel – Freely and confidentially discuss options and make decisions.

4. Email Delivery: Receive and Review Documents. Expert videos step you through each document. Note any questions or concerns you may have to discuss with your Counsel.

5. In person: Signing and Initial Funding Meeting – Transfer assets to your trusts. Payment of the balance of the fee.

6. In person: Follow Through Funding Meetings – Finish the Job!

7. In person/Zoom/Video: Ongoing support and Assistance

8. Cost: One-third to one-half of current fees, plus $119/month for ongoing funding and other services. Drop at anytime.

Do you want to fly first-class to Florida? Safe, Secure, Comfortable. Some folks do. And they are willing to pay the additional costs.

Do you just want to get to Florida? Safe, Secure, Some Inconvenience. Drastically reduced fee?

Either way, the process is safe and secure. You get every bit of security and asset protection.

As you continue as a member, you can add optional trusts and features. Membership has its privileges.

Get Everything You Need, Everything You Want

You do not have to settle for the disappointing failure of traditional estate planning. You can get the LifePlan™ Advantage at no greater cost to you.

Traditional Trust Planning Is Profoundly Mistaken

Why Do They Bank On Death?

Willful Ignorance Or Intentional Scam? Why Not Both?

Traditional estate planning supposedly avoids probate, saves taxes, and safely, efficiently delivers your remaining property and money to your heirs or beneficiaries. After you have passed on. Traditional estate planning is not concerned with you while living, only after death. Nobody cares what happens to you while you are alive. How does that help you?

Traditional estate planning fails because the overwhelming majority of us will need long-term skilled care. 70% of us. For an average of 3 years. And we will go broke paying for it.

Are you surprised that thousands of recreation properties: cottages, cabins, hunting land, are lost to pay for long-term care? Why is your estate planner surprised? Isn’t that their job? Or is your estate planner in denial?

You can defeat Nursing Home Poverty. LifePlanning™ empowers you. Keep your stuff. Get the care you have already paid for. Good for you. Good for your family. Good example for society.

When my mother suffered from the dementia which led to her death, over 10 years ago, their estate plan preserved their lifesavings. Mom’s months in the nursing home did not mean Dad’s impoverishment. Dad spent the last years with security and peace of mind.

Is Now A Bad Time For A Real Solution?

Perhaps you think you already have an answer to this problem. Maybe you do not see this as a problem at all. It is possible that you do not believe in the passage of time or its effects on you.

Peace of mind and financial security are waiting for everyone who practices LifePlanning™. You know that peace only begins with financial security. Are legal documents the most important? Is avoiding probate the best you can do for yourself or your loved ones? Is family about inheritance? Or are these things only significant to support the foundation of your family?

Do you think finding the best care is easy? Do you want to get lost in the overwhelming flood of claims and promises? Or would you like straight answers?

Well, here you are. Now you know. No excuses. Get the information, insight, inspiration. It is your turn. Ignore the message? Invite poverty? Or get the freely offered information. To make wise decisions. For you. For your loved ones.

The LifePlan™ Workshop has been the first step on the path to security and peace for thousands of families. Why not your family?