“There Are No Easy Answers, But There Are Simple Answers.”

“We Must Have The Courage To Do What We Know Is Morally Right.”

The Truth:

Why Your Trust Will Fail, Almost Always

1. Wrong Goals. You want to avoid probate, save taxes, make it easy for the kids. Everyone accepts the sales job. Everyone thinks these are the correct, popular, attractive goals. That’s why probate is never going away. The tax situation you leave is a mess. And the kids will be at each other’s throat.

2. Wrong Tools. Beneficiary designations, living trusts, pour-over wills, ladybird deeds. All intended to accomplish the Wrong Goals. No use when reality strikes.

3. Wrong Process. If you are using the Wrong Tools to achieve the Wrong Goals, is it any surprise that the Process is wrong too? Almost universally, so- called estate planners take the easy way out. They avoid the hard work, the follow-through that leads to success. The job is left half-done. You take the fall. And the blame.

4. Simple, But Not Easy. Ronald Reagan said, “There Are No Easy Answers, But There Are Simple Answers.” Effective planning, LifePlanning™ is not easy. But LifePlanning™ is simple.

5. Correct Goals + Correct Tools + Correct Process = Success. Is it wrong to focus on the real threats to your security and well-being? Is it foolish to use legal tools that have been proven thousands of times over the last thirty-three years? Is it worth spending a little more time and money now for lasting, lifetime success? Or do you wish to join the Probate Parade? Deceive yourself and your family? Invite Nursing Home Poverty? It is your choice, isn’t it?

Job #1: Avoid Nursing Home Poverty

People get old. Keep breathing in and out and you’ll see. It just happens. You are not as young as you used to be. Sixty is the new fifty. Yeah, but 80 is still 80. At least 90 is the new 80, right?

You cared for your parents. Folks in the neighborhood, the lady from church, nieces and nephews, other younger people could be hired to help. But today?

America is aging. We are, on average, getting older. We did not have as many kids as our parents. There are fewer young people. Fewer people to provide long- term care.

More old people. More demand for services. Fewer young people. Less supply of services.

What happens when there is increasing demand and decreasing supply?

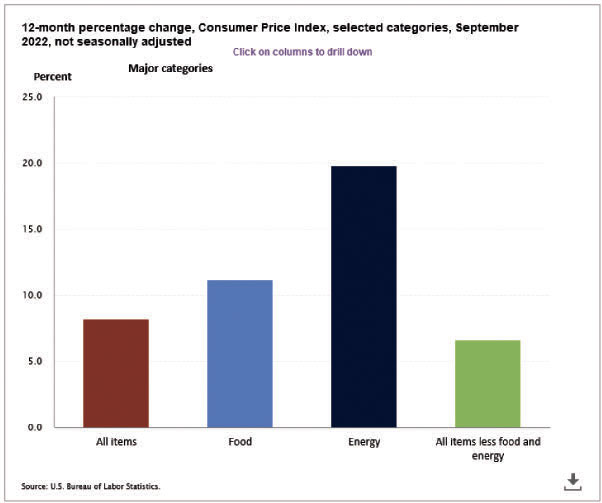

What happened to the price of infant formula when the biggest factory shut down?

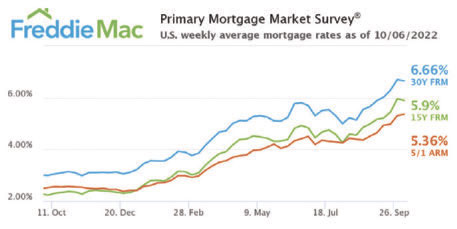

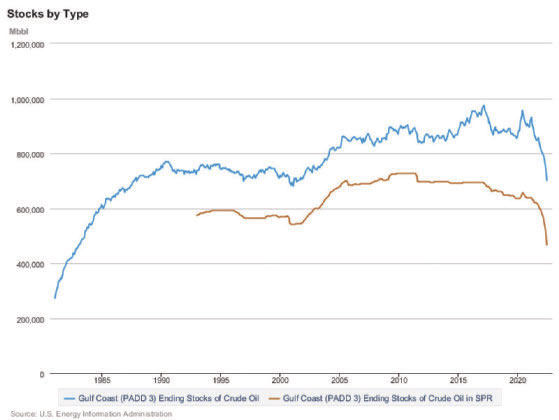

What happened to the price of oil when oil exploration leases were cancelled?

What happened to the price of gas when pipelines were shut down?

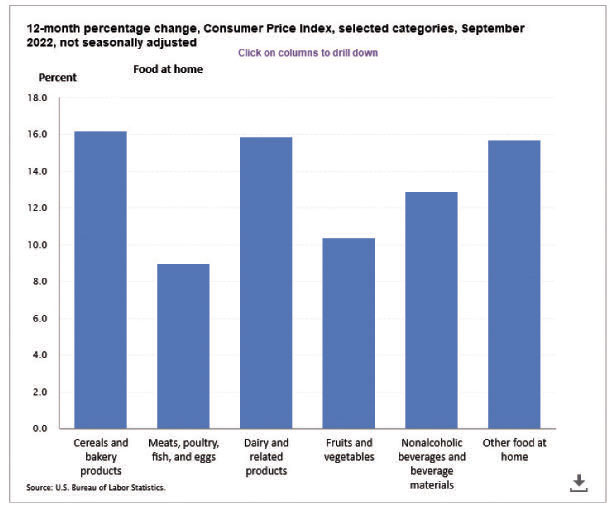

What happened to the price of eggs when avian flu hit the chicken coops?

What happened to the price of imported goods when the ports and harbors were clogged?

What happened to the price of electricity when somebody discovered that solar panels don’t work without the sun and there’s this thing called “night” that follows “day”? Or when the same somebody discovered that wind does not always blow?

What happens when supplies have already been taken by somebody else?

What if there were an unnamed virus of unknown origin that made people sick? And what if people believed that a certain type of respiratory mask would help avoid sickness? What if there were not enough “masks” to go around? What if someone looked ahead and got a supply of “masks”? If someone had planned ahead, what would the consequences be?

Every time you get behind the wheel of your automobile, you have a chance of dying in a car crash. Every single time. Americans do die in car crashes. One American dies for every 70,000,000 vehicle miles (that’s SEVENTY MILLION miles!) traveled. The average car trip is about 10 miles. So, you have a one in 7 million chance of dying each and every time you get into your car. (“Thank you” to the National Highway Transportation Safety Administration and the Bureau of Transportation Statistics for these numbers – your tax dollars at work!) Americans drive a lot. We drive so much that over the course of our lives, we have an almost 1% chance of dying in that crash. Thank goodness for air bags, crumple zones, and seat belts!

Another branch of our beloved federal government (Department of Health and Human Services) says that at age 65, you have a 70% chance of needing an average of 3 years of skilled care. A big chunk of us, 20%, will need more than five (5!) years of care. Skilled care can come from family members, friends, paid help, long-term care facilities.

Let us recap. Less than 1% chance of flaming car crash death like in the movies. Greater than 70% chance of long-term care. Which one do you care about? Which bad result do you strive mightily to avoid? Which unhappy ending do you simply accept?

Motor vehicle mayhem is bad! Somebody ought to do something! And you do. Drive safely. Buckle up. Hands on the wheel. You know the drill.

Nursing Home Poverty is bad! So let’s ignore it? Let’s pretend it happens to somebody else. Anybody else. Even though the reality is that Americans hardly ever die in car crashes and almost all need long-term care. Care that is harder to get and more expensive by the day. If you can get it at all.

How To Avoid Nursing Home Poverty

Hang Onto Your Money and Stuff While Qualifying for Benefits. You are a taxpaying, conscientious, charitable, forward-thinking, God-fearing American. You pay into the system. You expect some payback from the system. Safe roads. Clean water. Food that is not poisonous. Protection from bad countries that want to make war on us. Not so long ago, we also expected the police to stop shoplifters and vagrants. That was back when we also expected that our national borders counted for something. Remember? Good times, good times.

Social Security. Regular folks who go to work each day also expect that they will have a minimum sort of income when they can no longer work. We call this: “Social Security.” Payroll taxes go in, monthly payments come out. You, the American taxpayer, pay for Social Security. You get payback for your pay in. You don’t have to be broke to get the Social Security you have earned and paid for.

Medicare. Regular folks who go to work each day also expect that they will have a minimum sort of health care when they can no longer work. We call this: “Medicare.” Payroll taxes go in, Medicare taxes/ premiums go in, medical payments come out. You, the American taxpayer, pay for Medicare. You get some payback for your pay in. You don’t have to be broke to get the Medicare you have earned and paid for.

Medicaid. Regular folks expect that there will be no provisions whatsoever for long-term care. We call this the triumph of hope over experience. You pay until you are flat broke. You can keep your house, but have no money for upkeep, taxes, insurance, or utilities. When you are flat broke, you must pay almost all your income to the nursing home or residential care facility. After you are flat broke (except for $2K).

How is long-term health care different than short-term health care? Or income? Or basic income support? It all comes from your tax dollars. You paid for all of it. Why should you go broke? Why shouldn’t you have choices? How is any of this fair? And it gets worse…

What if you were not the penny-saving, bill-paying, overtime-taking, money-for-a-rainy-day-type person that you are? What if payday meant casino-day? What if you were a consistent over-spender? What if your bankruptcy lawyer was on your Christmas card list? Well, then that long-term care is free, free, free. You are in debt to your eyebrows? Come on down!

It is only the responsible people who suffer from the current long-term care situation. People who planned ahead for themselves and their families. People who believed that they had “saved enough” to take care of it. People who believed their so-called “estate planners.” Whoops!

How Do You Protect Yourself And Your Loved Ones By Protecting Your Stuff?

Simple Answer. Get long-term care benefits without going broke. Medicaid wants you broke. But you do not have to accept what Medicaid wants. You can protect what you have earned. Here’s how:

How Medicaid Works

1. What If You Give Away Your Stuff?

What if you give away your stuff and then apply for Medicaid benefits? Medicaid will say, “We will not help you. You had stuff and gave it away. And so we will not pay.” This is called the “Penalty Period.” Medicaid will excuse itself for a period of time. The more you gave away, the longer Medicaid will not pay. Right now, for every $10,000 you give away, Medicaid will not pay for a month. Give away $120,000, Medicaid will not pay for an entire year! But then Medicaid will pay.

In the meantime, while Medicaid is not paying, the nursing home is suing you. And your kids. And your friends, And your first-grade teacher. And anyone else you gave stuff to. You thought you could keep the house? Ha-ha. You thought you could keep an automobile. Yuk-yuk. Whoops!

Funny thing, though. What if you gave away your stuff more than five (5) years ago? What if sixty-one (61) months ago you gave all that stuff away? Then you applied for Medicaid? Things are different. Now Medicaid does not care that you ever had that stuff at all. Does not matter.

So perhaps you should give all your stuff away. Right now. To the kids. Your neighbors. Your first-grade teacher. Then wait for five (5) years. And if you ever need long-term care after that, no problem! Medicaid does not care that you had that stuff and gave it away. Great Plan!

By now, the sharpest knives in the drawer have spotted the problem with this brilliant approach, right? If you give your stuff away, then you have no stuff. And you like your stuff. What to do?

2. What If You Give Away Your Stuff Without Giving Away Your Stuff?

How can you give away your stuff without giving away your stuff? By using a particular kind of trust, that’s how. For Medicaid purposes, you gave your stuff away. For federal tax purposes, state tax purposes, common sense purposes, you did not give your stuff away.

The IRS doesn’t think you did anything when you put your assets in this type of trust. Medicaid says you “divested” those assets. Medicaid says you gave those assets away. Medicaid starts the Five-Year Clock. Five (5) years after putting those assets into that trust, Medicaid will not count those assets as yours. And you will qualify for the Medicaid benefits you have paid for. Without sacrificing your lifesavings, cottage, other stuff.

3. Why Should You Want To Qualify For Medicaid Benefits And Keep Your Stuff?

Why? Do you like paying for the same thing twice? Are you opposed to getting any return on your tax dollars? Does the government know what to do with your money better than you do? Would it be a bad thing to get the government benefits you’ve paid for and have additional lifesavings to purchase additional goods and services? Is it wrong to get the same deal from the government that irresponsible folks get? Would it be better to be flat, busted broke and forced to go to a nursing home than to supplement at-home Medicaid with lifesavings to remain at home? Are your kids and grandchildren so undeserving and ungrateful that you’d rather give your money to the government?

4. This Is Too Good To Be True! Tricksy Stuff Like This Never Works For Regular Folks! Plus It Must Be Wrong Or Immoral Or Something Else That’s Bad Or My Planners Would Have Told Me All About It! And What If I Move Out Of State? And Give Me A Minute And I’ll Think Of Something Else…

On February 8, 2006, Congress overhauled the Medicaid system. Congress replaced 50 states going in 50 different directions with some general principles that apply to everybody. Seventeen years ago, I was shocked when this happened. The Medicaid landscape was rewritten, much to the distress of our long-term care clients. Tools and techniques that had been proven reliable were wiped out. But there was a silver lining to this dark cloud of Medicaid reform.

No longer did it make sense to wait-and-see. The environment was different. Now we had some assurance that a Michigan plan could work in Florida. Or Texas. Or South Carolina. But not California, nothing works in California.

Not only did we have a legal structure that worked from coast to coast, we could rely on that structure to be stable. And so it has proved. Over the last 17 years, thousands of these LifePlanning™ trusts have been implemented by regular folks. And they have worked. Every time. Saving millions of dollars. For regular folks. To maintain dignity. To preserve families. To keep the promise that hard work, saving, planning, and doing the right things will have good consequences for you, your spouse, your family.

For every Medicaid application involving these trusts, we submit a full copy of the trust and all the supporting documents. Total disclosure. Candid honesty. Written evidence. Full documentation. This stuff works because we scrupulously, thoroughly, exhaustively comply with every law, rule, precept, and policy.

Going broke is a choice. Your choice. It is not chance, bad luck, or misfortune.

Why Don’t You Deserve A Little Payback For All The Taxes You Paid In?

Why Do You Want To Spend Your Last Nickel On Long-Term Care?

Why Shouldn’t The Government Spend Your Money For You?

Traditional estate planning is concerned with avoiding probate, saving taxes, and dumping your leftover stuff on your beneficiaries. After you die. Nobody cares what happens to you while you are alive. How does that help anyone? Stupid.

Traditional estate planning fails because the overwhelming majority of us will need long-term skilled care. 70% of us. For an average of 3 years. And we will go broke paying for it.

Is it surprising that thousands of recreation properties: cottages, cabins, hunting land, are lost to pay for long- term care? Why is your estate planner hurting you and your family? It is evil intent? Or stupidity?

LifePlanning™ defeats Nursing Home Poverty. Keep your stuff. Get the care you have already paid for. Good for you. Good for your family. Good example for society.

When my mother suffered from the dementia which led to her death, over 10 years ago, their estate plan preserved their lifesavings. Mom’s months in the nursing home did not mean Dad’s impoverishment. Dad spent the last years with security and peace of mind.

Is Now A Bad Time For A Real Solution?

Perhaps you think you already have an answer to this problem. Maybe you do not see this as a problem at all.

It is possible that you do not believe in the passage of time or its effects on you.

Peace of mind and financial security are waiting for everyone who practices LifePlanning™. You know that peace only begins with financial security. Are legal documents the most important? Is avoiding probate the best you can do for yourself or your loved ones? Is family about inheritance? Or are these things only significant to support the foundation of your family?

Do you think finding the best care is easy? Do you want to get lost in the overwhelming flood of claims and promises? Or would you like straight answers?

Well, here you are. Now you know. No excuses. Get information, insight, inspiration. It is your turn. Ignore the message? Invite poverty? Or get the freely offered information. To make wise decisions. For you. For your loved ones.

The LifePlan™ Workshop has been the first step on the path to security and peace for thousands of families. Why not your family?