Like Seriously, This Really Happened, Not Making It Up!

(Not Edited For Spelling Or Punctuation Or Anything Else) (Warning: Not Legal Advice!)

SEVERAL YEARS AT BERNIE’S?

QUESTION: What is it called when one deprives another notification of their parent’s death so to deprive them of their share of benefit?

I just found out that both of my parents have died, but years ago. After hoodwinking and railroading them, my mega millionaire sibling had taken measures to cut me off from them, before they’d died. It has been horrendous for me. Even just to find out that my parents had passed was bad enough, but that the way and how they’d died never would have happened if I’d not been cut out of their lives as I had been, after taking great and particular care of them myself, beforehand.

Short Answer: “Horrendous”? More like “Preposterous”! Mom and Dad die years ago. But until evil sibling got involved, you provided “great and particular care” that would inevitably have prolonged their lives. For years. But you, the “great and particular” caregiver, never wondered why all those Christmas and birthday cards kept getting returned? Are there no telephones? Did they live on Gilligan’s Island? Did you? I have “smell test” issues with this one… A little too self-serving, methinks

Long Answer: On the other hand, it is not unusual to see relatives who isolate and sequester disabled loved ones away from other family members. Sometimes the child acts from the best of generous, honorable motives: offering a refuge of peace for the loved one, away from family feuding, squabbling, and raw emotional outbursts. Sometimes domineering impulses, seasoned with jealousy, and spiced with greed motivate the selfish child to restrict access.

Unless there is objective abuse, usually, working out the currents of control are left to the family. Courts and judges have no interest or expertise in resolving the emotional debris of decades, and in some cases, generations. Judging from the unceasing torrent of self-help books on the subject, it does not seem that anyone else has any “great or particular” success with these heartfelt matters either. We must all do the best we can. “It’s a fool who looks for logic in the chambers of the human heart.” Joel Cohen.

Longer Answer: But this question is not all about “hearts and flowers” is it? Oh no! Our correspondent is particularly concerned that the mega millionaire sibling acted “so to deprive them of their share of benefit”. And by benefit, our correspondent means money. Or property. Or other stuff. So, what about that?

When stuff is at stake, courts do get involved. It is what they do best!

UNDUE INFLUENCE!

“Undue Influence.” is the legal theory. Here is how it works. Four (4) scenarios. Mom has money. Mom also has 2 children, A and B.

Scenario #1 No Undue Influence

1. Mom likes Child A better. And always has.

2. For years, without change, Mom’s will or trust leaves all her stuff to Child A.

3. Mom lives and acts independently.

4. Mom up and dies.

5. Child A gets everything. Child B is sick as mud.

6. Child B can go pound sand.

Scenario #2 Challenger Must Prove There WAS Undue Influence

1. Mom likes Child A better. And always has.

2. Recently, Mom, changed her will or trust to leave all her stuff to Child A.

3. Mom lives and acts independently.

4. Mom up and dies.

5. Child A gets everything. Child B is sick as mud. Child B sues.

6. Child B must prove that Child A unduly influenced Mom. An almost impossible task.

7. Child B can go pound sand.

Scenario #3 Defender Must Prove There WAS NOT Undue Influence – Formal Fiduciary

1. Mom likes Child A better. And always has.

2. Mom appoints Child A as her Trustee and Agent. In writing.

3. Mom changes her will or trust to leave all her stuff to Child A.

4. Mom up and dies.

5. Child A gets everything. Child B is sick as mud. Child B sues.

6. Now it is Child A who must prove that Child A DID NOT unduly influence Mom. An almost impossible task.

7. Child B gets a half-share. Child A can go pound sand.

Scenario #4 Defender Must Prove There WAS NOT Undue Influence – Informal Fiduciary

1. Mom likes Child A better. And always has.

2. Mom moves in with Child A. Child A helps with all Mom’s decisions. Child A prevents others from visiting Mom. Mom is totally dependent on Child A.

3. Child A is not Mom’s Trustee and Agent.

4. Mom changes her will or trust to leave all her stuff to Child A.

5. Mom up and dies.

6. Child A gets everything. Child B is sick as mud. Child B sues.

7. Now it is Child A who must prove that Child A DID NOT unduly influence Mom. An almost impossible task.

8. Child B gets a half-share. Child A can go pound sand.

Key Take-aways With Undue Influence: If you must prove it, you lose it. Also, if the beloved parent has appointed you formally, in writing, as their trusted agent/advisor/trustee, then you must prove you did nothing to “unduly influence” the beloved parent. The same rule applies, even if there is nothing in writing, if the beloved parent is dependent on you.

So, if you are caring for mom, dad, auntie, grampa, and providing for all their needs, or they “honored” you with the responsibility of trustee or agent, you MUST establish, by affidavit, deposition, or otherwise, that the beloved relative was acting independently. If you do not, you will lose.

KID’S NAME ON DEED IS NO-GOOD, AWFUL, VERY BAD

QUESTION: WHAT IS THE BEST WAY TO PUT AN ADULT CHILDS NAME ON CONDO OWNERSHIP WITH ELERLY PARENT.

Mom is elderly.. She is of sound mind and has mentioned to me that she would like to get my name on her condo.. what does that entail?

Is that what joint tenancy is? What will alleviate issues upon death – in other words avoid probate…. My guess is she needs to hire an attorney. What paperwork should I have her gather together.

Short Answer: “Best Way”? How about “No Way”!

Long Answer: Folks like to put their kids’ names on deeds, stock certificates, bank accounts, investments, and anything else they can think of. There is simply no good reason to put your kid’s name on this stuff. If you only want to avoid probate (dumb!), use a revocable living trust. If you want to avoid probate and nursing home poverty, and have time, use a LifePlanning™ Trust. If you don’t have time, use a trust plus a transfer-on-death deed (in Michigan and a few other states).

The Thing: Here’s the thing, most “estate planning” attorneys cheerfully admit that they have no clue as to what is going on with long-term care. Most so-called “elder law” attorneys should admit the same thing. It is tough to discern good advice when it comes to planning for long-term care. That means you have a tough job, but it is doable.

Ask the following questions:

1. How many Medicaid divestment trusts have you drafted for clients?

2. What happens after I sign the documents?

a. Do you have a mandatory process to get my stuff into the trusts?

b. Do I get my original trust documents?

c. How do you verify that my stuff has been retitled to my trusts?

3. How many Medicaid programs are available for long-term care?

4. Can I get help with skilled care at home? How much will that cost?

5. How many Medicaid applications have you personally prepared and filed for clients?

6. What is the PACE program?

7. What is Medicaid waiver?

8. What is the Initial Asset Assessment? When does it happen?

There are lots more questions to ask, but by this time, most attorneys will be shaming you for wanting to preserve your lifesavings. They think it is ridiculous that you should get some pay back on the tax dollars you paid in. They think you should go broke. They think your spouse or family should be happy with crumbs. Do you think they are on your side? Let’s not be too harsh… maybe they just don’t know any better. It’s more than possible, it’s likely.

NO GOOD DEED GOES UNPUNISHED

My older friend wanted me to come stay with him to due to personal and cancer reasons. he asked my ladyfriend to become his caretaker and he would cover her living expenses. She ended up paying for everything food etc….. he even spent checks he was suposed to give her…. He passed away almost a year and a half of her caring for him like an angel being maid nurse cook, but she wants to know how long she has to pack up.

Short Answer: As long as you can drag out the eviction process.

Long Answer: You and your lady friend the angel have nothing in writing from your deceased “older friend”. Probate law will not allow you to make any claim for payment or even reimbursement for the “food ect”. Plus your friend embezzled the checks the angel was supposed to receive!! That all stinks. But in this world of ours, the reward for generosity is often resentment and selfishness. Look around. You know I’m right.

Longer Answer: They cannot make you leave the house without going through the formal eviction process. In some places, COVID rules may still prohibit evictions. It’s worth finding out. Legally, you are a holdover tenant or tenant at sufferance. The new owners of the house cannot simply put you on the street. They must give you 30 days’ notice, Termination of Tenancy. You can leave at that point or make them go to court for an Order of Eviction, after a Summary Proceeding.

Why not make them go through the whole darn process? Unless they agree to reimburse you for the grocery money. And a few bucks on top?

Moral of the Story: You are not a bad person for wanting to get a written agreement to pay you money in exchange for services. You are a smart person, with a good heart, who does not want to be played for a chump. So get it in writing!

Medicaid Observation: The payments you get under the agreement will not be acceptable to Medicaid and will be treated as gifts with penalties to the “older friend.” So what? If the friend needs you to give the money back, do so (if you are able). Then do a promissory note with interest so that eventually you will get every nickel to which you are entitled. And not a penny more.

Lawyer Sales Pitch: Don’t try to do this yourself. You have to pay for the privilege of working diligently for 18 months and when it is all said and done, you will get evicted. Is it possible that all this could have been avoided? Maybe with a little legal counsel? Maybe?

I’m As Mad As Hell And I’m Not Going To Take This Anymore!

— Howard Beale, Network, 1976

How Did It All Go So Wrong, So Quickly?

We’re Not Gonna Take It, No, We Ain’t Gonna Take It, We’re Not Gonna Take It Anymore!

— Dee Snider, Twisted Sister, 1984

Traditional estate planning is concerned with avoiding probate, saving taxes, and dumping your leftover stuff on your beneficiaries. After you die. Nobody cares what happens to you while you are alive. How does that help anyone? Stupid.

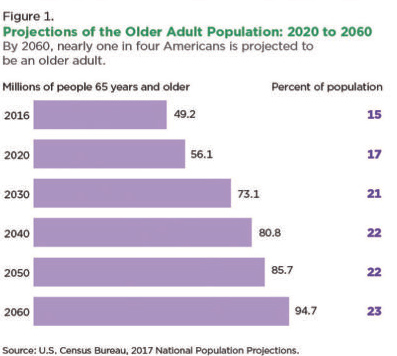

Traditional estate planning fails because the overwhelming majority of us will need long-term skilled care. 70% of us. For an average of 3 years. And we will go broke paying for it.

Is it surprising that thousands of recreation properties: cottages, cabins, hunting land, are lost to pay for long- term care? Why is your estate planner hurting you and your family? It is evil intent? Or stupidity?

LifePlanning™ defeats Nursing Home Poverty. Keep your stuff. Get the care you have already paid for. Good for you. Good for your family. Good example for society,

When my mother suffered from the dementia which led to her death, over 10 years ago, their estate plan preserved their lifesavings. Mom’s months in the nursing home did not mean Dad’s impoverishment. Dad spent the last years with security and peace of mind.

Is Now A Bad Time For A Real Solution?

Perhaps you think you already have an answer to this problem. Maybe you do not see this as a problem at all. It is possible that you do not believe in the passage of time or its effects on you.

Peace of mind and financial security are waiting for everyone who practices LifePlanning™. You know that peace only begins with financial security. Are legal documents the most important? Is avoiding probate the best you can do for yourself or your loved ones? Is family about inheritance? Or are these things only significant to support the foundation of your family?

Do you think finding the best care is easy? Do you want to get lost in the overwhelming flood of claims and promises? Or would you like straight answers?

Well, here you are. Now you know. No excuses. Get the information, insight, inspiration. It is your turn. Ignore the message? Invite poverty? Or get the freely offered information. To make wise decisions. For you. For your loved ones.

The LifePlan™ Workshop has been the first step on the path to security and peace for thousands of families. Why not your family?