News You Can Use, Without All The Yakety-Yak

If You Liked It, Why Didn’t You Put A Ring On It?

QUESTION: Evicting common law spouse from my home? Can I be forced to modify my house for his mobility and care?

Common law spouse decided to have his daughter handle all of his financial and medical care. Prior to this I was an authorized signing agent which I was used for utility’s, groceries and various joint accounts. His daughter will only give authorization for $200 towards electric, purchase his food and handle his medical needs. He has major medical issues. Eventually him will required the use a wheelchair. I myself have been diagnosed with early stages of Dementia and COPD. And limits my abilities as well. No other contribution are made. Intimidating tactics such as demanding $50,000 for him to leave. Or sale my home and give him half. Repeated threats by he and his daughter regarding him leaving. On a daily bases harassing me about the money he claims he is owed to him. Can I legally evict him? Can I be forced to sell my home which was fully paid for 2yrs prior to him moving in? Can I be required to modify my home for his mobility needs?

Throw The Bum Out, And His Little Dog, Too

1. There is no “common law” marriage in Michigan. Show Freddie the Freeloader the door with instructions on use. If he won’t go willingly, evict him. And his pernicious progeny (that means his devil daughter). What an ungrateful wretch!

2. “Repeated threats by he and his daughter regarding him leaving.”

Correct Response To Threats: “Don’t let the door hit you on the keister on your way out!”

3. Specific Questions – Precise Answers

a. “Can I legally evict him?” Yes. Follow the rules exactly. You don’t want to do this part twice.

Or three times.

b. “Can I be forced to sell my home which was fully paid for 2yrs prior to him moving in?”

No. Hell no!

c. “Can I be required to modify my home for his mobility needs?” Nope.

NOTE: Common Law Marriage is recognized by Colorado, Iowa, Kansas, Montana, New Hampshire, Oklahoma, Rhode Island, South Carolina, Texas, Utah, and the District of Columbia. In these localities, if you hold yourself out as married, you are married. It is not a matter of how long you have been together.

So, say “boy/girlfriend,” “significant other,” or “Poopsie”. Do not say, “Husband,” “Wife,” or “Spouse.” And keep your finances separate.

But I Ain’t Got No Money, Honey!

QUESTION: Can I walk away from my mom’s business and home without doing anything once she dies?

My mother has become increasingly irresponsible with money. She is super intelligent, and she has no dementia. She is 86 and still runs her business but it is highly dysfunctional and I’m not sure it makes a lot of money. She gets lots of loans and has taken all her money from a reverse mortgage on her house. She won’t listen to reason. She is secretive about her finances, and she is controlling. I believe she gets these loans knowing she will probably die before she has to pay them all back. I don’t even know how I would be able to unwind any of this to even pay the debts off after to trying to sell her business.

I’m considering just walking away and not doing a thing after she dies as long as I could do this without any legal ramifications for myself.

Where Were You When The S—t Hit The Fan?

1. You are not liable for mom’s debts. Now or after she dies.

2. You might be liable for mom’s debts if she gave stuff to you so that she would be unable to repay. This is the Doctrine of Fraudulent Transfer or Fraudulent Conveyance.

a. Accept nothing from mom for which you did not pay.

b. Maintain books and records to show you supported yourself.

c. Keep your distance. When the proverbial S hits the fan, you do not want to get splattered.

3. At mom’s disability or death, refuse to act as attorney-in-fact, guardian, or conservator. Walk away. Let a public, court-appointed guardian or conservator try to unscramble these eggs.

4. Parents must accept their children’s choices. Children must accept their parent’s choices. And not be ruined in the process.

5. Consult with counsel to erect a legal firewall between you and the dumpster fire that will be your mom’s financial legacy.

6. Love your mom. And don’t be a victim.

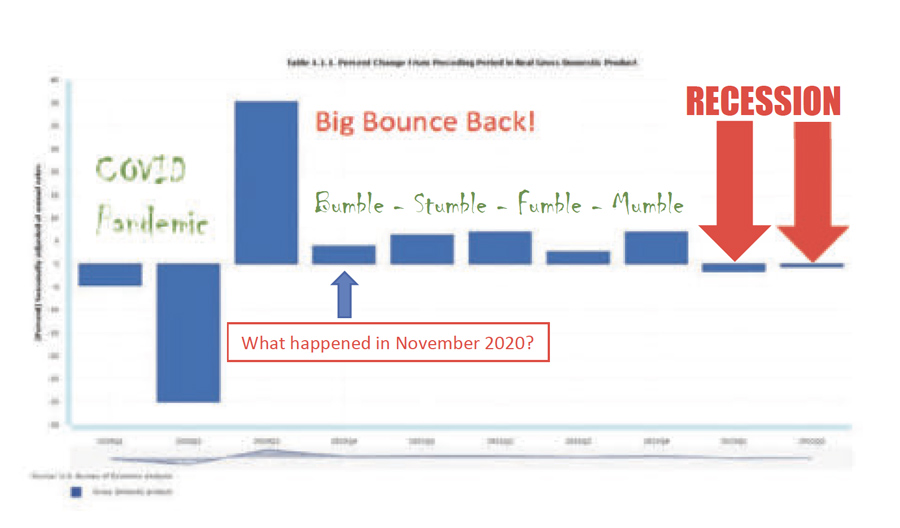

NOTE: Nursing homes, lenders, and creditors of all stripes are responding to the deepening recession by aggressively pursuing non-traditional sources of payment. Meaning they’re coming after family, friends, the postman, anybody they can find who may have benefitted from the borrowing. It is not the mom- and-pop law firms doing this sort of collection work. Debt collection law firms are highly organized, technically savvy, and using legal techniques that were once reserved for the “big” cases. They are not going away.

Daddy Dearest

QUESTION: How do I get a full-time aide for my father who refuses to pay for it?

My father is 96 with several co-morbidities. He is in hospice at home I am his full-time aide. I need a break from caring for him 24/7 for the last nine months. The hospice personnel say they can give me 5 days I need a month or more off. He has on-set dementia which I cannot get the Dr’s to sign off on. He can get violent and I am at my wits end with him. When he was normal he was abusive and now he is controlling and manipulating. I need to get away to take care of myself I am 75 yrs old. I thought I could help but this is way too much. He is difficult to manage. What can I do legally I have POA only medically not financially?

Loving, Devoted Child Or Enabling Co-Dependency?

The Parent Child Relationship Is Not A Suicide Pact

1. Get away. Don’t go back.

2. Make dad get a Probate Court- appointed guardian and conservator through:

a. Adult Protective Services

b. Hospice social worker or case manager

c. Local, neighborhood Elder Law Attorney

3. When spouses care for one another, the caregiver spouse dies first 40-50% of the time. Why? Because caring for a loved one is tough, tough stuff. And you are living the worst-case scenario: Dad has “several co-morbidities.” Plus “dementia.” And on a good day, dear old dad was “abusive.” Nowadays, he can “get violent,” “controlling,” and “manipulating.” Ay caramba! What to do?

4. You recognize that “this is way too much.” Remember what Lucy VanPelt said to Charlie Brown: “As they say on TV, the mere fact that you realize you need help indicates that you are not too far gone.”

5. Now’s the time to arrange for a professional guardian and conservator to take over. Paraphrasing 2 Timothy 4:7- 8: You have fought the good fight, you have finished the race, you have kept the faith. 8 Finally, there is laid up for you the crown of righteousness…

6. Love your dad. And don’t be a victim

How Long Do They Expect Us To Meekly Go Broke?

Social Security Doesn’t Demand Your Last Nickel

Medicare Doesn’t Touch Your Lifesavings

So Why Do You Have To Go Broke For Long-Term Care?

When Is Enough Enough?

Traditional estate planning is concerned with avoiding probate, saving taxes, and dumping your leftover stuff on your beneficiaries. After you die. Nobody cares what happens to you while you are alive. How does that help anyone? Stupid.

Traditional estate planning fails because the overwhelming majority of us will need long-term skilled care. 70% of us. For an average of 3 years. And we will go broke paying for it.

Is it surprising that thousands of recreation properties: cottages, cabins, hunting land, are lost to pay for long- term care? Why is your estate planner hurting you and your family? It is evil intent? Or stupidity?

LifePlanning™ defeats Nursing Home Poverty. Keep your stuff. Get the care you have already paid for. Good for you. Good for your family. Good example for society.

When my mother suffered from the dementia which led to her death, over 10 years ago, their estate plan preserved their lifesavings. Mom’s months in the nursing home did not mean Dad’s impoverishment. Dad spent the last years with security and peace of mind.

IS NOW A BAD TIME FOR A REAL SOLUTION?

Perhaps you think you already have an answer to this problem. Maybe you do not see this as a problem at all.

It is possible that you do not believe in the passage of time or its effects on you.

Peace of mind and financial security are waiting for everyone who practices LifePlanning™. You know that peace only begins with financial security. Are legal documents the most important? Is avoiding probate the best you can do for yourself or your loved ones? Is family about inheritance? Or are these things only significant to support the foundation of your family?

Do you think finding the best care is easy? Do you want to get lost in the overwhelming flood of claims and promises? Or would you like straight answers?

Well, here you are. Now you know. No excuses. Get the information, insight, inspiration. It is your turn. Ignore the message? Invite poverty? Or get the freely offered information. To make wise decisions. For you. For your loved ones.

The LifePlan™ Workshop has been the first step on the path to security and peace for thousands of families. Why not your family?