Truth, Lies, Mistakes, BS. Can We Agree On The Basics?

Some Truths are obviously true. Other Truths need proof. Some of the following Truths are self-evident and some other Truths supported by government data:

• Wealth in America Comes from Work

• Some Countries Have Kings and Queens, America Has Workers and Entrepreneurs

• Americans Become Rich the Old-Fashioned Way – We Earned It

‘[A] little girl born into the bleakest poverty knows that she has the same chance to succeed as anybody else …’

—Barack Obama, inaugural address, 2013.

‘We must create a level playing field for American… workers.’

—Donald Trump, inaugural address, 2017.

Barack Obama and Donald Trump both proclaim that hard work creates success. 70% of their fellow Americans agree. Hard work, Skills, and Intelligence are rewarded. Less than 20% of Americans believe that coming from a wealthy family is essential to getting ahead. Even the liberal Brookings Institution had to admit it. International Social Survey Program, 1998–2001.

Obama and Trump don’t agree on anything. But they share a faith in American meritocracy. Grit, hard work, taking advantage of opportunities, these are the building blocks available to all.

Fashionable theories spouted from ivory towers by pointed-headed pencil-necks rooting around for their next free taxpayer-supported educational grants cannot obscure the evidence of your own eyes.

• Americans Acquire Lifesavings Over a Lifetime of Earning, Saving, and Investing

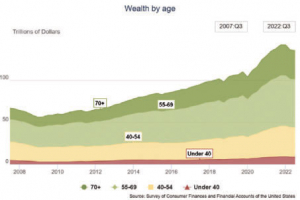

As time goes by… wealth by age grows steadily. It is not magic. It is not economic theory. It is not luck. Americans who work and save and invest, do well. Americans who spend and borrow and spend some more, do not.

• America’s Greatest Generation Saved the World from Nazis, Had Lots of Kids, and Died Broke

• America’s Baby Boomers Saved the World from Communists, Had Few Kids, and Got Rich

• America’s Wealth Is Concentrated in Baby Boomers

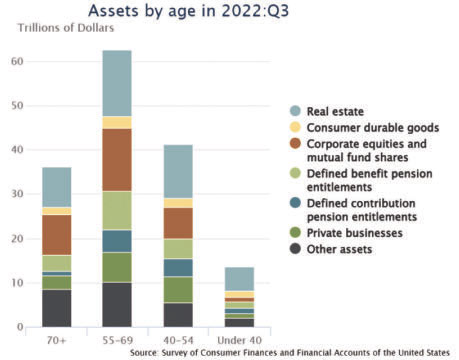

Americans aged 55 and older own almost 100 Trillion Dollars in various assets. That is twice as much as Americans 54 years old and younger.

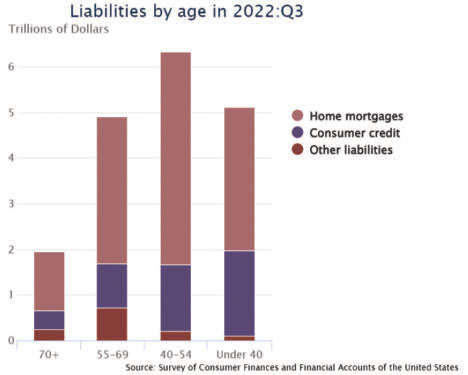

Americans aged 54 and younger owe more than 11 Trillion Dollars in various debts. Younger Americans owe almost twice as much as older Americans aged 55 and up.

As a group, Baby Boomers own twice as much and owe half as much as the younger generations.

• Baby Boomers Are Getting Older Just keep breathing in and out.

• Baby Boomers Are Getting Older and Rich

Just keep breathing in and out. And do not spend your money.

• Older Baby Boomers Need Long-term Care

• There Are More and More Older Americans Demanding Care

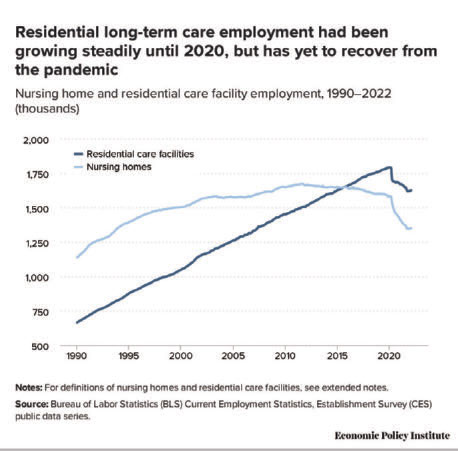

• There Are Fewer and Fewer Young Americans Supplying Care

• When Demand is High and Supply is Low, Prices Skyrocket Wildly

Three-quarters of the money to pay for long-term care comes from your taxpayer dollars. Only 27.7% comes from the person receiving the services. So, why do estate planners ignore this need?

• Estate Planners Ignore the Need for Long-term Care

• Long-term Care Impoverishes Most Baby Boomers

• Baby Boomers Die

• Estate Planners Break Their Promise to Avoid Probate

• After Long-term Care Impoverishes Older Americans, the Probate/Estate Planner Industry Profits from the Scanty Leftovers

• Why do Estate Planners Ignore Long-term Care?

• Why do Estate Planners Practically Promote Probate?

Traditional trust-based estate planning neglects the essential step of securing assets into the trust. The result is that the trust fails. Now the client’s beneficiaries must endure the full probate process to receive any inheritance.

Could traditional trust-based estate planners be at fault? Is it possible that the 4-10% of each estate that goes to attorney fees have an effect on the estate planners? Are you being well-served by traditional planning? Is traditional planning merely an excuse to exploit your family one last time?

Human Beings Make Four (4) Kinds Of Statements Truth, Lies, Mistakes, BS

Some people tell the truth, the whole truth, and nothing but the truth. All the time. Every time. No matter what the temptation. Even if they are sure to get away with it. Only 10% of human beings are these incorruptibly honest folk. The rest of us will lie (and justify it to ourselves) if there is a great enough benefit. And if we believe that no one will find out. Big Incentive + Small Fear = Less Than Truth.

Truth is an intentional statement that corresponds to what the person sees. Lies are purposeful statements that do NOT correspond to what the person sees. The liar knows the truth and says something else to deceive the listener. Mistakes are statements that are incorrect, but the speaker was trying to describe the situation accurately. The person spouting BS does not care whether his statements are true or false. Statements made to manipulate, to gain advantage, to satisfy greed, these are all BS. The point of BS is not to communicate effectively, but to achieve one’s own goals without regard to the truth.

Truth-tellers we can all rely on. Liars may grow ashamed and give up their lies. Those who make mistakes might become more careful and develop into reliable companions. Those who take the BS path, however, seduced by the power of the dark side to exploit others, they harm us without consequence.

Do Traditional Estate Planners Peddle BS?

There Are Only Four Possibilities… Ask Yourself These Four Questions:

1. Are Estate Planners Truthful?

Accurate Perception and Accurate, Effective Advice Are they doing their best to inform and serve? Do they

accurately report what they see? Are they as expert as they claim? Do they consistently achieve the results they honestly promise?

2. Do Estate Planners Lie?

Accurate Perception and Deceptive, Damaging, Self- Interested Advice

Do they know the truth and deceive? Are they aware that they fail? Are they corrupt in word and deed? Do they lie to steal from you? On purpose?

3. Are Estate Planners Mistaken? Inaccurate Perception and Damaging Advice

Do they fail to discern the truth? Is their perception so faulty that they cannot see accurately? Is their failure in good faith because they do not appreciate reality? Are they ignorant and inept, wasting your resources?

4. Are Estate Planners Spouting BS?

True or False is irrelevant. Do they want to manipulate you so much that they do not bother to find out whether what they say is true or false? Are they self-centered and selfish to the point of blindness? Is there anything they will NOT say to con you?

Traditional Estate Planners do not warn you of the dangers of long-term care. They do nothing to protect you from the greatest threat to your lifesavings. And they speak as if there were no danger at all. Traditional Estate Planners set up trusts. The trusts are never completed. Your assets are never conveyed to your trust. Your trust fails. And then comes probate.

Let’s analyze the Traditional Estate Planner, in light of the incentives and opportunities.

INCENTIVE: If the Traditional Estate Planner did the required work so the trust would avoid probate, there would be no probate fees. No 4-10% shrinkage of your estate. The Probate Industry is huge. The transfer of assets from the Baby Boomer generation to younger generations is just getting underway. Why would the Probate Industry sacrifice its share of the tens of trillions of dollars that will be transferred from Boomers?

OPPORTUNITY: The Traditional Estate Planner promises “No Probate”! But that promise is made to you. While you are alive. While you are planning. When it comes time for the promise to be fulfilled, the Traditional Estate Planner is no longer dealing with you.

You have become incapacitated through dementia; you are now unaware of the torrent of lifesavings flowing from your bank accounts. You will have to rely on your successor trustees and agents. Trustees and agents who do not know the promises that were made to you. Trustees and agents who are unable to enforce those promises.

You have died. Your heirs and beneficiaries show up to the Traditional Estate Planner’s office expecting to receive their shares without probate. How sorrowfully, with great crocodile tears, will the Traditional Estate Planner blame you for the fact that there is nothing in your trust. All assets still in your name must now pass through probate. With all the hassle and expense. Why were you not told? Why was there nothing more than a couple pages of instructions that most people never read? Perhaps because it was all BS. It was never about you. It was always about the Traditional Estate Planner’s agenda and profit.

Must Estate Planning Be The “Big Con”?

No. You can get what you need. But you must be aware of the risks. That’s why in-depth introduction meetings are essential. Full understanding. Open door.

Thousands of families have benefited. Thousands have avoided nursing home poverty. Why not you?

Vaporized Like A Snowflake On A Hot Griddle

Is It Fun To See Your Lifesavings Imploding At $12,000 Per Month?

Is It A Bad Idea To Get Some Payback On Your Taxes?

America is getting older. So are you. There are fewer young people. More older people.

Older people need care. Older people need younger people to provide that care. But there are fewer younger people. Demand for care is up. Supply of caregivers is down. Prices for care are skyrocketing.

Everyone knows someone who has gone broke. Not from the casino. Not from credit card debt. Not from too many toys. Someone who has gone broke from long-term care.

Basic at home care: $30+/hour.

Nursing care at home: $60+hour.

Basic Assisted Living: $7000/month

Basic Nursing Home: $12,000-15,000+/month

Everyone knows that care is expensive and getting worse.

Simple steps taken now will preserve your lifesavings, home, dignity and provide well for your surviving spouse.

But some foolish folks ignore their own lives. Whistling past the graveyard. Focus on death… who gets my stuff? No care for their surviving spouse.

Is it wrong to get some payback for the tax dollars that you have paid in?

Are you opposed to making the rest of your life the best it can be?

Is it fair to burden your spouse, family, or friends when help is right there for the asking?

Has your success in life come from burying your head in the sand?

Why hasn’t your estate planner, lawyer, financial advisor informed you? Why have you been misinformed?

Is now a bad time to explore LifePlanning™?

Thousands and thousands of local families have already experienced the benefits. Do you deserve nursing home poverty? Do you wish to leave nothing for your family? Is it a ridiculous idea that you should get the care you have already paid for?

Is Now A Bad Time For A Real Solution?

No one has all the answers but is this the wrong time to start asking questions?

Is finding the best care is easy? Is getting lost in the overwhelming flood of claims and promises a good idea? Are you opposed to straight answers?

Ignore the message? Invite poverty? Or get the freely offered information. To make wise decisions. For you. For your loved ones.

The LifePlan™ Workshop has been the first step on the path to security and peace for thousands of others. Why not you?