by Bill Bereza, Associate Attorney

“Where there’s a will there’s a way.” – George Herbert, Jacula Prudentusm (1640).

Most people believe estate planning is important, but less than half have made any plans.[i] In my experience with myself, and with friends and family, the road to good estate planning follows similar paths, which I like to think of as the six stages of estate planning.

Stage 1: Denial. I’m not going to die soon.

“I intend to live forever, or die trying,” – Groucho Marx.

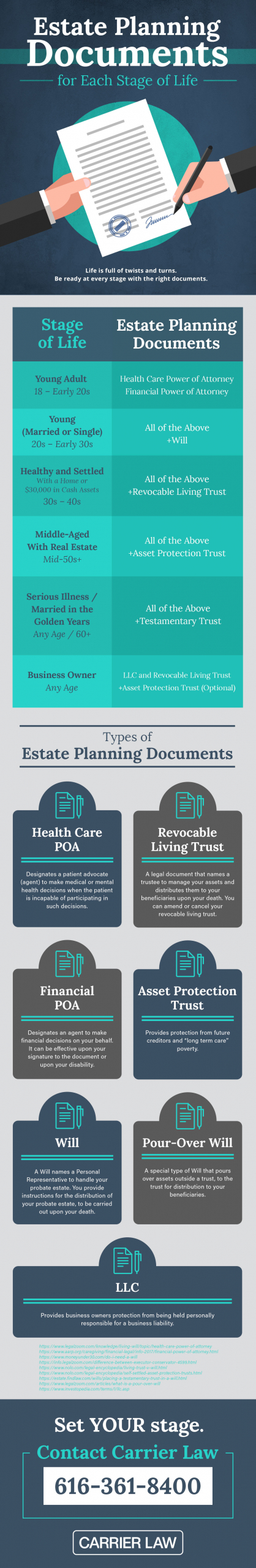

This is the myth that estate planning is only for people who know when they’re going to die. So far, I haven’t met anyone who knows the day or the hour when their time is coming.[ii] And estate planning is also about more than just where your stuff goes when you die. It’s about how you get taken care of when you’re alive. A Patient Advocate Designation makes sure someone can make medical decisions for you when you’re unable. A Durable Power of Attorney ensures that your finances and your stuff are protected. A Trust will simplify the job for someone to manage your income, investments, and expenses.

Stage 2: Defeatism. I don’t care what happens after I’m dead.

“What you leave behind is not what is engraved on stone monuments, but what is woven into the lives of others.” – Pericles.

An estate plan isn’t just about you and your stuff. It’s about providing comfort and assistance for the loved ones you’ve left behind. Most people go through life wanting to make things easier for the people they love, want to help them through life. Your lack of planning will just add to the pain and grief they’ll already feel when you die. The families left behind often face a lot of uncertainty about the right thing to do. Why not try to eliminate some of that doubt for them?

Stage 3: Delusion. My kids will divide up things among themselves.

“Who knows what evil lurks in the hearts of men? The Shadow knows…”

If you sat in Probate Court and watched the painful legal fights between kids over their parents estates, and if you asked the opposing sides why they’re in court, each of them would most likely say it’s because they’re trying to fulfill their parents’ wishes. Your kids probably are the best and closest group of people you know, and your relationship with each of them is probably close, and open, and sincere. You know what you’ve told your kids, and you may think each child understands what you want, but like the child’s game of telephone, each of your kids will have their own idea of what you want and what’s right and fair. If you’re lucky, all your kids will be on the same page. That’s only a guarantee if you only have one child.

Stage 4: Overconfidence. I have named my kids as beneficiaries and joint owners on everything.

“If anything can go wrong, it will.” – Capt. Edward A. Murphy, U.S. Air Force.

You’re a do-it-yourself kind of person, who doesn’t believe in Murphy’s Law. Your plan is to share everything equally with your kids, so you’ve named them equally on all your accounts and properties. If nothing ever goes wrong, if no kid ever gets sued, if they never face divorce, if they never have a mental illness or physical disability, if they never change, then maybe your stuff can get to your kids. And this is if you haven’t missed any accounts, and never get any new property, and give every kid a copy of all your keys and passwords every time they change.

A good estate plan takes care of all the “what if” unexpected outcomes of life.

Stage 5: Fossilization. I’ve made an estate plan, so I don’t need to think about it again.

“Plans are nothing; planning is everything.” ― Dwight D. Eisenhower, former U.S. President

If your life never changes, you never need to change your plans. The most common mistake made by people who have planned, is to throw that plan in a closet and never speak of it again. Not only does a plan need to change, because you and your life change, but the plan needs to be shared with others. Your family, your beneficiaries, your helpers, all should know what you’ve done, what you want, and what you expect.

Stage 6: Acceptance. Life is a process, not a destination. Planning to Plan.

“Life is a journey to be experienced, not a problem to be solved.” — Winnie the Pooh

You’ve made a plan for yourself and your family for today and for when you’re gone. You understand that a plan is worthless if it doesn’t represent what matters to you in your life today.

You will review and update your estate plan regularly. You’ve planned and have a plan to keep planning. Because life always changes, you will keep looking, learning, and thinking.

[i] https://www.caring.com/caregivers/estate-planning/wills-survey/

2. What

2. What 3. What

3. What 4. What

4. What 5. What

5. What

Marge and Walter have a beautiful cottage on the lake in Grand Haven, in addition to their primary home in Grand Rapids. Beth and her family look forward to weekend visits in the summer. Her children feel like it’s their summer home because they spent so much time there with Nana and Grandpa. Due to distance and their own busy lives, Dave and Mark haven’t been to the cottage since they were little.

Marge and Walter have a beautiful cottage on the lake in Grand Haven, in addition to their primary home in Grand Rapids. Beth and her family look forward to weekend visits in the summer. Her children feel like it’s their summer home because they spent so much time there with Nana and Grandpa. Due to distance and their own busy lives, Dave and Mark haven’t been to the cottage since they were little.